2023 provided investors with no shortage of events and developments to grapple with, whether it be ongoing geopolitical turbulence or incredible advancements in the field of artificial intelligence. We believe the current environment is well suited to active management, with high quality companies providing investors with an attractive mix of resilience and growth.

As we reflect on the past year, the investment climate has been marked by significant events and trends shaping investments and the general economic outlook. The ongoing geopolitical tensions, notably the Russian invasion of Ukraine and the escalated conflict between Israel and Hamas have contributed to a climate of political uncertainty. These events have had far-reaching economic impacts, further complicating the investment environment.

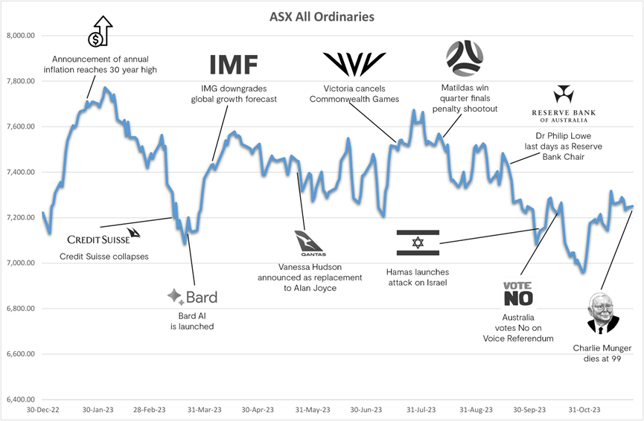

The following chart of the S&P/ASX All-Ordinaries Accumulation Index provides some idea of events that have impacted the market over the past twelve months.

Source: ECP

Amidst these challenges, we've seen global inflationary pressures prompt aggressive interest rate responses from central banks through time. Recently, the rhetoric from central banks has softened, suggesting that while further rate hikes are possible, rates might stabilise near current levels for the foreseeable future.

The equity risk premium remained high throughout the year, reflecting the market's sensitivity to these global events. This underscores the importance of investing in resilient businesses capable of weathering macroeconomic fluctuations, especially for those with a long-term investment horizon.

While macro/political events have dominated the media, technological advancements have been transformative with Generative Artificial Intelligence (AI) models emerging as a dominant theme in business discussions worldwide. While analysts and researchers have used algorithms to analyse and use data sets to make predictions for decades, it was the release of NVIDIA’s CUDA (compute unified device architecture) software for developers in 2006 which enabled scientists to apply parallel processing in complex simulations and data analysis. Parallel processing utilises two or more processors (CPUs or GPUs) to handle separate parts of an overall task, laying the foundation for machine learning.

Within this context, even OpenAI would take 300 years to train ChatGPT 3.5 on the fastest single GPU, but with parallel processing and using 1024 GPUs, it can be done in 34 days. The resultant development of large language models like ChatGPT, is revolutionising industries. These developments highlight the importance of investing in businesses that can harness these technologies to enhance their competitive advantage and growth potential.

In this regard, the U.S. and China are leading the AI development race, with significant investments pouring into this technology, while Europe appears to be a laggard. This rapid growth has prompted governments, particularly the U.S., to develop regulations to ensure the safe and trustworthy evolution of these technologies, with many trying to get to grips with the inherent risks associated with the use of the technology, particularly in the areas of cyber security and privacy.

The recent executive order by US President Joe Biden has been designed to impose national rules on the fast-moving technology to ensure “safe, secure and trustworthy” development. More importantly, this will enable businesses to understand the ground rules and legitimately organise and obtain data without breaching data privacy regulations.

In 2023, ChatGPT consumerised these AI developments that had previously been happening behind closed doors, enabling text, language, speech, and image recognition to cross over human capability. The net result is significant reinvestment in technology, showing up in GPU demand from the Big 5 Tech companies, the owners of proprietary hardware (e.g., NVIDIA) and large-language models (e.g., Microsoft, Google, Amazon, Meta).

Of particular interest for business are “Large Language Models” (LLM), which can train on billions of parameters to develop refined algorithms for new use cases. Clearly, it is also of the utmost importance to ensure that the businesses in which we invest need to utilise these emerging technologies and harness them effectively to expand their economic footprint and enhance investment value.

To this end, our investment process is centred on assessing businesses' Dynamic Capability (DC). DCs are pivotal, change-oriented capabilities that empower firms to adapt and reconfigure their resources in response to evolving customer demands and competitive landscapes. This includes a firm's agility in R&D, its ability to enter new markets with nimble operational structures, the consolidation of central support functions following acquisitions, and the replication of successful processes or systems in new geographical or business sectors.

The impact of early adoption of AI cannot be overstated; the potential economic unlock will be meaningful. AI's potential to transform economic landscapes is immense, as it enables the efficient reading and structuring of vast amounts of corporate data coupled with powerful workflow automation tools (think a far more powerful Excel macro).

This combination is set to revolutionise business processes, much like the advent of computer mainframes in the 1980s, significantly reducing manual accounting work. By investing in quality companies that are early (effective) adopters of AI, investors can position themselves at the forefront of this transformative wave, ready to reap the economic benefits.

As we navigate this new AI era, we focus on meticulously evaluating companies' business models, financials, and growth plans. This approach helps us identify quality growth stocks poised for long-term success, leveraging AI to capitalise on market trends and demand.

For us, we continue to explore the advancements in AI, renewable energy, and biotechnology that present potential for substantial long-term returns. Identifying and investing in companies leading these innovations position portfolios to benefit from future market transformations.

Looking ahead

In the evolving technological landscape, it's become increasingly clear how pivotal AI will be in shaping future strategies. While short-term applications of AI, such as customer service chatbots and co-pilot productivity tools, are becoming more commonplace, the broader vision of leveraging AI to revolutionise corporate strategy is still unfolding. This transition, particularly in the context of leveraging vast corporate data, may be gradual due to inherent corporate risk aversion.

During a recent flight to the Global Federation of Competitiveness Councils meeting, the following Socrates quote came to my attention: “The secret of change is to focus all of your energy not on fighting the old, but on building the new.” This sentiment encapsulates the transformative journey corporations must undertake in the AI era.

For investors, the tangible benefits for companies that effectively integrate AI can be broadly categorised into three areas:

- Productivity Enhancement: AI can significantly augment people-centric processes within organisations, unlocking new levels of efficiency and workflow optimisation.

- Creation of New Revenue Streams: Leveraging AI for personalised marketing and data-driven insights allows for novel revenue generation strategies, transforming how businesses interact with customers.

- Sustaining Competitive Advantages: AI enables the development of unique customer solutions that are challenging to replicate without access to extensive historical data. This creates a formidable competitive edge.

As we step into this burgeoning AI-driven era, our focus at ECP remains on evaluating the business models, financial health, and growth strategies of potential investments in a careful, considered and committed way.

A thorough approach lets us pinpoint those quality growth stocks poised for long-term success. Their agility, ability to swiftly capitalise on emerging opportunities and adeptness at applying AI to harness market trends and demands are critical factors in their continued success and the creation of substantial long-term value for our investors.

Companies with an SCA are especially well-positioned to reap the economic benefits of AI. Their resilience to market disruptions (i.e., business model disruption or price-led competition) and the high barriers to entry for competitors needing similar data assets make these quality companies well-positioned to capture and retain the economic benefits of AI while maintaining their competitive excellence.

Over the past few years, our industry and society have evolved more broadly with heightened expectations of corporate responsibility. Being a compassionate corporate citizen, committed to people, the planet, and the community, is no longer optional but essential.

At ECP, we proudly embrace these values, as evidenced by our third annual Sustainability Report. We are committed to ensuring that our business employs best practices to position our organisation so that we can continue to sustainably grow through time.

We appreciate our role in the investment community, and we will continue to focus on growing our clients’ financial wealth, but our commitment extends beyond financial growth to include contributing to the societal well-being of future generations.

Turning to our portfolio, we're encouraged by the notable uptick in our companies' price-to-earnings (P/E) ratios, rebounding from previous lows. This, combined with robust short-term financial indicators – including organic sales growth, solid earnings, and increasing dividends – fortifies our confidence in the future. This positive trend suggests a promising trajectory for valuation enhancements across our investments.

The recent performance of our portfolio underpins our optimistic forecast, with an anticipated internal rate of return (IRR) of ~14%. Given the current market landscape, we see a prime opportunity to invest in high-quality franchises. These market conditions are ideal for investors seeking resilient, growth-oriented investments, positioning them well for long-term outperformance.

At ECP, our primary focus is investing in quality businesses within the growth phase of their lifecycle. For investors, the material de-rate of equity valuations, particularly for growth-oriented stocks, and the expected ongoing volatility present an opportunity for those investing in resilient, Quality Franchises - it's time to step in and invest.