In the world of investing, ‘flight to quality’ is the action of moving capital away from riskier investments. Recent market commentary on Corporate Travel Management (‘CTD’) has convinced some investors to pack their bags, whereas we, ECP Asset Management (‘ECP’), view this as irrational behavior and an opportunity to buy a quality business at a more sensible price.

Market concerns regarding the investment quality of CTD, allege poor managerial decisions around aggressive accounting and poor disclosure practices, and questions around the integrity of management through their ghost offices in Europe and America have been raised. We acknowledge some recently identified issues are valid and require investigation, others are immaterial.

What to focus on

We find the two core market concerns surrounding CTD are:

1. Revenue Legitimacy; and

2. Organic Growth.

At ECP, our investment process relies upon the company’s ability to continue to grow and generate returns to shareholders outside of acquisitions. This also needs to be based on the reliability of the company’s accounts. Our analysis below is representative of our current thinking on CTD and has not been validated by the company. But first let’s look at why we invested.

Why We Invested

CTD has been an investment in our portfolio for a number of years. The business demonstrates strong return metrics and exhibits high-quality business features and processes. We are obsessed with finding businesses with a Sustainable Competitive Advantage that have an ability to grow their economic footprint through time. Our intensive research process embraces meetings and interviews with customers, suppliers, industry heads, and is complemented by precise financial analysis.

Our research found that CTD focuses on providing superior customer service. The company uses its own proprietary technology and tools to facilitate this service and this enables them to leverage existing staff and offerings to drive margin expansion. The unique focus on customer Return on Investment (ROI) is a key driver of the firm’s success.

CTD is well positioned to continue to deploy their domestic growth model and expand it into new markets via sensible acquisitions. Further, the global scale of the business drives returns as the offerings to customers and clients continue to improve. The company will continue to innovate and their culture will help it achieve top line growth and bottom line margin expansion.

Revenue Reliability

When investigating the legitimacy of revenue and earnings of CTD, we assess the reliability and relevance of the historical accounts. Central to our assessment is the ‘Billing and Settlement Plan’ (BSP) and the Accounting Standard AASB 107.

Understanding the BSP is key to comprehending what is going on behind the numbers. The BSP is used in the settlement of travel costs between customers, agents and travel providers (airlines). BSP streamlines payments for CTD, yet it creates timing issues related to cash flows which have been used as evidence for the short thesis.

Importantly, AASB 107 allows an agent to report Cash flows on a net basis for “cash receipts and payments on behalf of customers when the cash flows reflect the activities of the customer rather than those of the entity”.

AASB 107 Impact on BSP

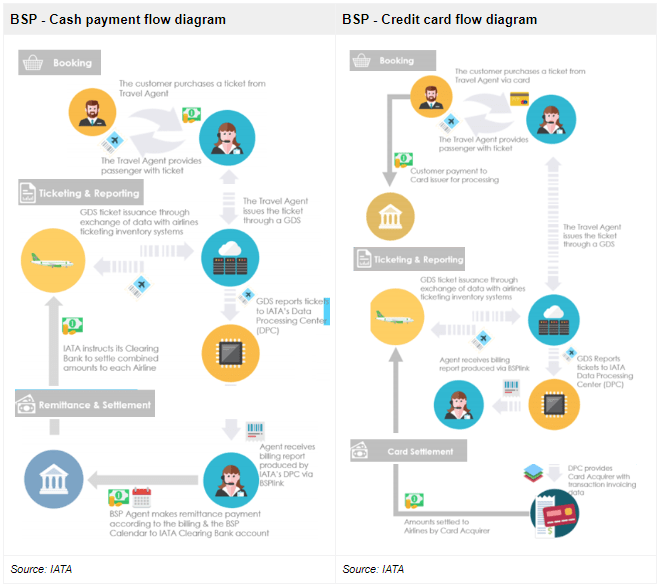

According to IATA, the BSP is a central point through which data and funds flow between travel agents and airlines. Instead of every agent having an individual relationship with each airline, all of the information is consolidated through the BSP. Agents make one single payment to the BSP (remittance), covering sales on all BSP Airlines.

For us, there are two key payment methods to analyse, Cash and Credit. The majority of CTD’s customers are engaged in credit payments. Importantly, cash is more prevalent in Asia and, as a result, the exposure to cash swings will increase for CTD as they increase their Asian footprint. Both forms of transactions create significant volatility for CTD’s cash balance, receivables and payables.

An illustrative example highlights the potential impact these payments can have on CTD’s overall cash flows and how it can materially impact the ‘Payments to suppliers and employees’.

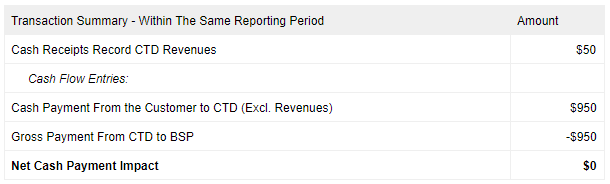

E.g. Assume a customer purchases an airline ticket for $1000. The ticket is split as a $950 payable to the BSP (for the airline) and $50 of revenue for CTD (commissions and fees).

Assuming there are no timing differences in customer receivables or customer/BSP payables, then the required accounting entries are:

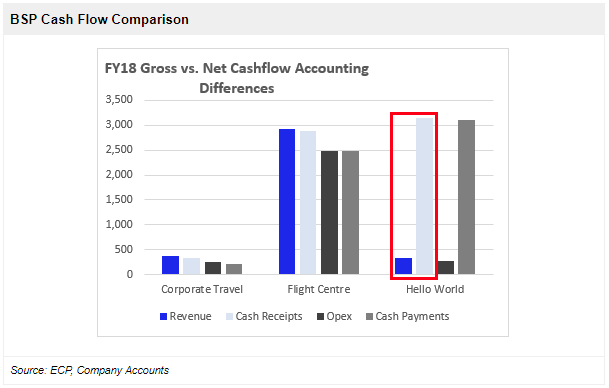

AASB 107 allows CTD to net the cash flows for reporting purposes. Since there are no timing differences, the statutory accounts would not reveal the $950 cash transaction. Reporting styles vary between companies, with Flight Centre Travel Group Ltd (FLT) following a similar structure, whereas Hello World Limited (HLO) recognise the BSP remittance under “payment to suppliers and employees”.

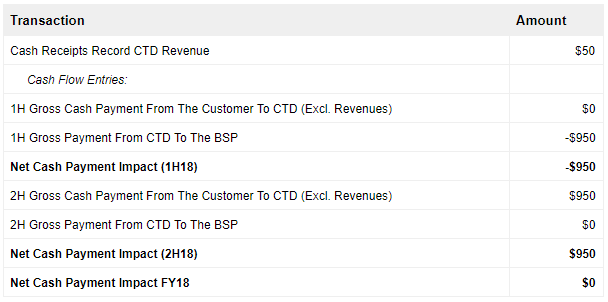

When timing differences at reporting affect receivables and payables, the net cash flow accounting creates the appearance of material volatility in the half-yearly cash flow statement, specifically ‘Payments to suppliers and employees’. Differing BSP payment terms create timing differences and this is further distorted by differing terms with customers.

An example of overlapping reporting periods is:

Our example highlights that the cash BSP transaction abnormally increases the 1H18 ‘Payment to suppliers and employees’ and appear to inflate cash outflows. In 2H18, the ‘netting’ of the customer receivables is reversed within the same line item. This gives the appearance of unusually low cash outflows in 2H18, yet the net effect by year-end is zero. This process can be misleading for investors when reconciling to the income statement. This was witnessed in CTD’s 2H18 accounts which accounted for $62m in ‘Payments to suppliers and employees’, despite employee expenses posting $96m.

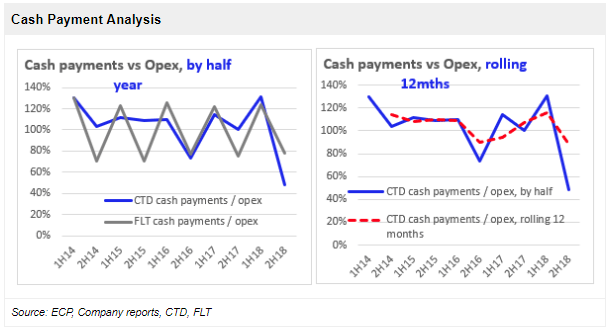

In a similar fashion, FLT experiences volatility in its ‘Payments to suppliers’ relative to its operating expenditure across shorter time periods. Both CTD and FLT have similar ‘net’ cash flow accounting for their BSP transactions. We take a 12 month rolling view when assessing the accounts, and through this lens, 1H18 cash payments appear materially higher than previous seasonality and make the 2H18 payments appear less concerning.

By understanding the relationship between agents and the BSP, the impact of net accounting is key to gaining comfort in their accounts. The impact in CTD’s accounts are:

- Cash flow volatility;

- Reported cash variability due to working capital requirements; and

- Interest discrepancies due to daily calculations.

We highlight a clear distinction between CTD, FLT and HLO regarding the magnitude of timing differences between customer receivables and payables. FLT and HLO’s predominantly leisure business takes advanced customer deposits before paying suppliers which results in a higher volume of customer cash relative to Total Transaction Value (TTV). Notably, the higher cash balance reduces the volatility between reporting dates and consequently reduces the ability to generate interest income.

A preferred comparison is Hogg Robinson Group PLC (HRG) which is similarly exposed to the corporate segment. HRG has a low implied interest rate on its cash balance that is similar to CTD. See below which highlights the comparison of CTD and HRG’s cash & interest earned over time.

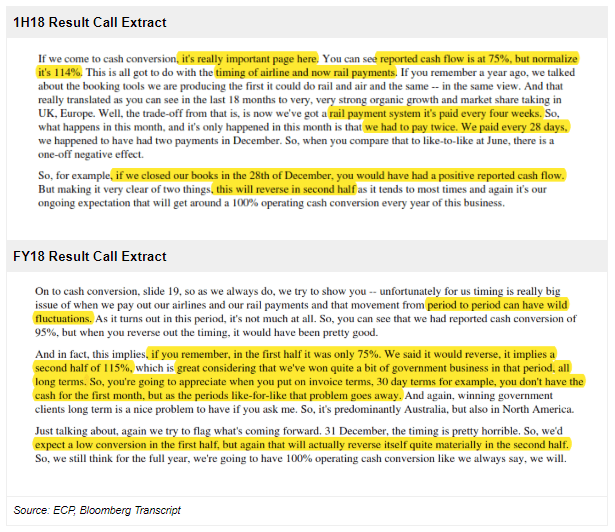

CTD management has been very explicit in terms of explaining this issue to investors but it has stopped short of explaining the mechanics of BSP and ‘net’ cash flow accounting. Our examples help explain the underlying cash flows and give us confidence in the financial accounts. We provide extracts from the result call transcripts that highlight the impact on cash flows, and further how the impact of BSP payments lead to 115% cash conversion in 2H18.

Revenue Recognition

In FY18 CTD relaxed its revenue recognition policy regarding Pay Direct Commissions (PDCs). Management made reference to this change in the FY18 accounts although a typographical error created some confusion. Historically, revenue was booked when the transaction was complete, however, the changes meant revenue is recognised when it can be “reliably measured”. We monitor any accounting treatment changes regardless of materiality and in this circumstance, we are comfortable that all issues have been addressed.

Revenue Quality & Receivables

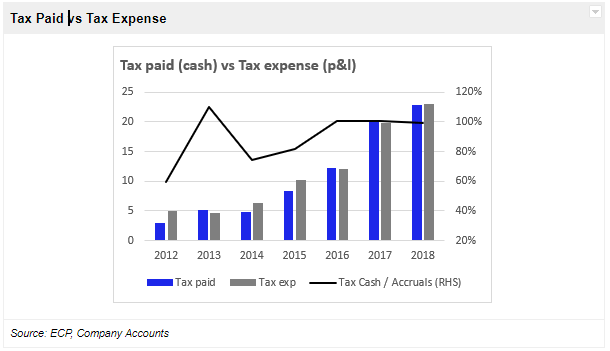

Understanding the cash and accrual composition of revenue is vital when assessing the quality and legitimacy of a firm’s cash flows. Historically, cash receipts have fluctuated during the year equaling approx. 100% of revenue throughout a full financial year indicating a solid history of cash conversion, notwithstanding material volatility in smaller time periods.

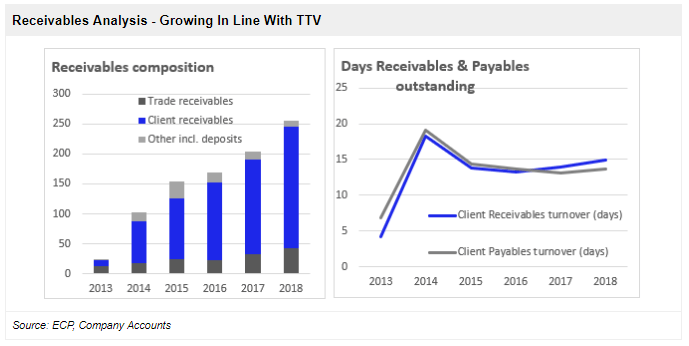

We note that while receivables are large and growing in absolute dollars, growth remains in direct proportion to TTV (see below). We believe the key component of receivables relates to customer receivables which arise in the provision of booking services, as opposed to trade receivables which relate to commissions owed to CTD. Their customer receivables have been in line with TTV growth since 2015 and show payments outstanding are approx. 14–15 days. We emphasise that this seems logical given the average BSP processing period is 14 days.

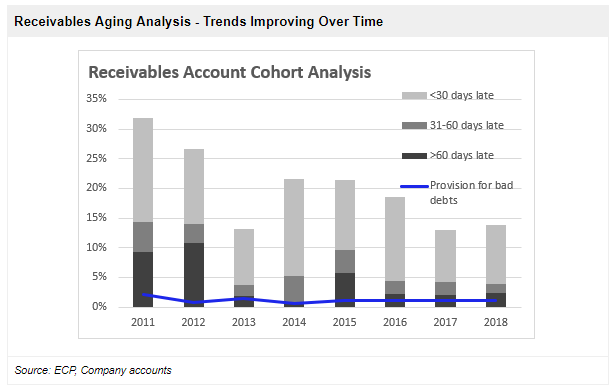

An additional observation is that the receivables age profile appears to be improving over time, with a lower percentage that is classified as overdue.

We take comfort that tax paid from the cash flow statement has been consistent with the tax expense reported on the income statement. Importantly, the pre-tax cash profitability being reported to the tax authority is consistent with the profitability being reported to financial markets.

Growth Drivers

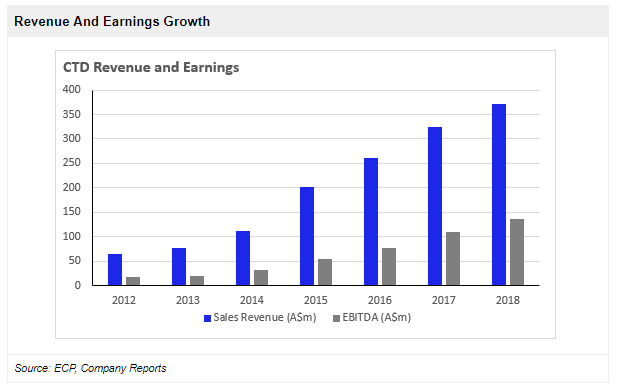

CTD’s growth has been a combination of acquisitions, organic growth via new customer wins and increased transaction volumes and through the increased application of technology to the customer base. CTD has grown market share above 15% and has adequate coverage over the domestic market and the company generates superior EBITDA margins due to transitioning customers on to its online platform.

Acquisitions will continue to be a contributor to further business growth. While acquisitions do play a large strategic role, management has been successful at building a strong domestic business that will continue to grow sustainably. We believe their success domestically provides us with the most appropriate case study to understand their potential for international expansion, and we highlight the scale benefits are beginning to drive margin expansion.

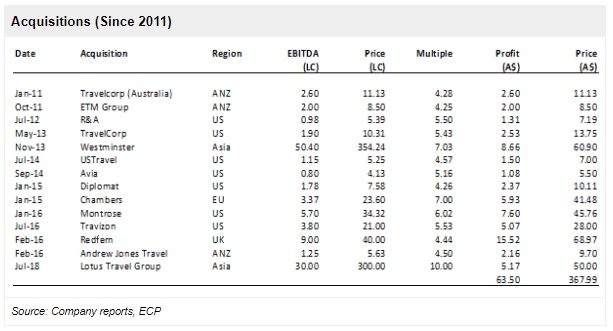

CTD’s acquisitions exhibit material revenue and cost synergies. The success of this strategy has been highlighted in the regional performances and the margins growth seen across the business. Below outlines the acquisitions made since 2011 and factors in revenue and cost synergies. Notably, this results in a positive ROIC.

When assessing where the growth has come from, the below highlights regional acquisitions and separates EBITDA growth into organic, acquired and FX contributions for the period. These have been weighted at the time the acquisition was integrated into the accounts. We demonstrate that organic growth has been a material contributor to EBITDA growth over time. CTD is attempting to acquire scale in Europe and the US in the medium term, however, in the long-term we expect this to shift toward organic growth, similar to its domestic performance.

Superior Profitability Versus Peers

CTD has grown consistently over the long-term and is a highly successful travel management company. To determine the driver of their success, we interviewed respective customers and suppliers and the overwhelming feedback from these combined parties indicate 3 key success factors:

- Superior Customer Service;

- Focus on Customer ROI; and

- Technology Stack.

Our discussions with domestic customers reveal that the intense focus on the customer through superior service which has a focus on customer ROI, and their multi-technology solutions are the core drivers of this success. CTD are differentiated by service through their client-centric model, and as such are not the cheapest solution in the market. Reputably, when it comes to customer ROI, CTD is leagues ahead of the competition, and this is compensated with superior profitability.

CTD has a premium technology stack which they ensure integrates with customers existing software systems to get the right outcomes. We view the technology offering from CTD as an acceptable competitive advantage which arises from the ability of management to deliver an enriched customer experience. The total offering is proprietary in nature but the technology itself may not be.

When you combine these characteristics with the successful acquisitions that CTD has made over the year, the growth in revenue and earnings is evidence of a successful strategy.

Conclusion

In the market place there are always ‘bulls’ and ‘bears’ and their respective commentaries brings about healthy debate.

In a time whereby many corporates are facing allegations of being untrustworthy or dishonest, we encourage and applaud all efforts to bring disclosure and transparency to the fore. Integrity and credibility are necessary to achieve sustainable growth over time, and for any investment we continue to test our assumptions to ensure that the companies we allocate capital, are good custodians of that capital.

We stand by our original investment thesis and believe CTD will continue to grow organically and via acquisition and will continue to deliver above-average economic returns through time. In accordance with our process — we will deploy capital into CTD as the share price weakens.

The article has been prepared by ECP Asset Management Pty Ltd. ECP is a funds management firm based in Sydney, Australia.. For further information visit www.ecpam.com. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for financial advice. ECP owns shares in Corporate Travel Management Ltd. ABN 26 158 827 582, AFSL 421704, CAR 44198.