The telecommunications industry has (largely) enjoyed growth through consolidation and cost-cutting initiatives. Telcos missed the last opportunity when the over-the-top (OTT) players reaped the rewards from their underlying infrastructure. The evolution of technologies presents a unique opportunity, and TPG Telecom is best positioned for 5G given its low-cost operating model, price differentiation, and limited legacy products. TPG has seen remarkable growth, and the story has just begun.

For any investor, finding a significant investment opportunity usually begins by identifying a paradigm shift. TPG Telecom (ASX: TPM) is Australia’s third largest telco and is a company that is still run by its founder, David Teoh. Over its history, TPM has quietly gone from strength-to-strength making long-term strategic decisions that have resulted in substantial shareholder value over time.

Here at ECP Asset Management (ECP), we seek to identify quality franchises that sustainably expand their economic footprint over the long-term. We are business owners, not share traders. Our process aims to find quality businesses that operate in favourable industries and can reinvest at high returns on capital by leveraging their sustainable competitive advantage.

For us, the management team is central to our process as they will ultimately bring our investment thesis to fruition. We want trustworthy organisations that have a track record of delivering on a long-term strategy; provided with integrity.

Some years ago we identified a paradigm shift in the telco industry, and we invested in TPM. Some questioned our decision, citing the sector has been the worst performing on the ASX; the reality of the National Broadband Network (NBN) was becoming clear; the lack of pricing power was accelerating margin pressures; and, an increasingly competitive operating environment.

Generally, telco investment opportunities relied upon industry consolidation. Stagnant industry revenues, government intervention, and changing legislation created uncertainty and tempered expectations of future growth. These short-term headwinds that engulfed the market were a prime distraction from the longer-term investment opportunity.

So What’s Going On?

The daunting challenge presented by the NBN is well known. Usually, when a government intervenes, it’s best to remain on the sidelines. Government intervention, more often than not, is found to have an adverse effect on shareholder wealth and the rollout of the NBN is no exception.

The telco industry has historically operated in two distinct segments: fixed and mobile. We will call this the ‘old world’. Previously, these segments have used separate technologies that have been the backbone of the services they have provided.

The NBN has levelled the playing field and reduced barriers to entry for fixed-line services. There are over 180 providers now operating in the market, yet, despite a more competitive market, 92% of the broadband market is held by four players: Telstra (ASX: TLS), TPM, Optus, and Vocus. When products become commoditised, scale and the lowest cost to serve (administration, support and billing) is key to economic success.

Moving to mobile, the industry dynamics are somewhat different. Until recently, we have primarily seen an oligopolistic market structure. At the start of the decade, TLS and Optus mainly enjoyed the market to themselves given the #VodaFail issues at Vodafone Hutchison Australia (ASX: VHA). With VHA back on track and TPM being the new entrant, the industry looks set for major competitive disruption.

Current mobile technology is a combination of 2G, 3G, 4G, and 4G LTE. Each stage saw a technological change and required different equipment and protocols. 1G, analog voice; 2G, digital voice; 3G, mobile data (emails); 4G, mobile internet; and, 5G, machines wireless (IoT).

The Mobile Evolution

Many predicted the demand for mobile services would render fixed-line networks obsolete; the opposite appears to be coming true. The rapid growth in mobile services is proliferating. The need for data has put enormous strain on our mobile networks and increasingly the only solution to meet these demands is fibre. We are now entering the fixed-line and mobile convergence.

Fixed-Mobile Convergence

It’s been said, you can’t drive forward looking through the rear view mirror. For years, we’ve acknowledged a paradigm shift is underway and it’s been a test of our convictions. For us, recognising the disconnect between the markets understanding and what’s developing within the industry presents a healthy, long-term opportunity.

There is a gradual convergence of technologies. No longer are separate technologies running fixed-line and mobile communications. New generation telcos are enabling a true consumer-centric world and fixed-line, and mobile networks are becoming complementary. Modern networks are moving toward the same base technology.

Modern, high-performance fibre improves the capabilities of a mobile network and once we enter a 5G world, will be the only technology capable of delivering the backhaul needed for such services. To support 5G networks, operators require fibre backhaul to meet requirements for security, timing, latency and quality of service (QoS).

Incremental costs of building out a mobile network on top of fibre are far less cumbersome than building out a separate network, as was previously done. Trenching cable and rolling out a national fibre network add significant complexity and cost, and in most cases will prove to be cost prohibitive in today’s terms — as evidenced by the NBN.

The $50 Billion Opportunity

A report by Deloitte found that 5G technology will contribute $50 billion to Australia’s economic growth. Knowing the industry landscape, understanding technological changes and finding a management team with a strategy that exploits this technological revolution over the long-term will best place investors to achieve superior returns.

To compete, scale and fibre assets give significant competitive advantages to incumbents who hold both resources. It is salient to realise that fibre is better at carrying data than any wireless network due to fundamental and sustainable technology advantages. The bottom line for operators is that to meet the demand for mobile services (profitably), a holistic approach to building the network is required.

TPM adopted the approach to invest now and prepare for the next ten years. Management is planning an integrated network deployment that will achieve superior cost-to-capacity ratios. Their investment is the foundation of its network and the use of virtualised tools, rather than the physical legacy equipment, provide immediate cost-advantages.

Lower costs, greater resource efficiency and new service revenue streams are key to the success of a converged network. The recent technological developments will drive TPMs cost advantage and create a better user experience that unlocks future revenue streams.

Technological Developments

Firstly, small cells are the most cost-efficient way to meet the massive demand for data. There is virtually unanimous agreement among industry experts that small cells are the future for the mobile industry. Small cells, when deployed judiciously, can be a source of competitive advantage and differentiation. When strategically placed, the radios are closer to users, and this substantially improves speed and coverage; and subsequently improve the QoS.

Secondly, self-organising network automation technology, such as Software Defined Networking (SDN) and Network Function Virtualization (NFV), brings immediate cost-savings and performance benefits. By replacing hardware with software, networks are smarter and cheaper. SDN and NFV create an open network development environment which facilitates innovative services and offerings.

Thirdly, Cloud Ran or C-RAN. Simply, the telco tech gurus decided to change the functions performed by the large, energy consuming base stations (the hardware under the large macro mobile towers) into the software. By making this change, there are significant energy and labour savings, and greater efficiency gains that ensue due to a centrally managed network.

Mobile networks are becoming more complex to configure, optimise and maintain. The combination of these technological developments (amongst others) with fibre backhaul will decrease mobile backhaul costs while simultaneously improving bandwidth, reliability, availability, monitoring, and end-to-end management capabilities.

Smart Pipes

Globally, telcos have suffered declining revenues, lacklustre cash flows and low investment returns. Over-the-top (OTT) operators such as Google, Netflix, and FaceBook have been able to extract value from the infrastructure owners. Telcos were forced to focus on survival tactics such as cutting costs, move into adjacent business opportunities, or to acquire and consolidate. These tactics have meant certain key players have become highly profitable; this strategy can only go on for so long.

Telcos have historically owned and operated ‘dumb pipes’ and have missed the opportunity created on the back of their infrastructure investments. Customers are connecting to their networks through voice, text and other smartphone interactions. These interactions are a constant source of data, and to date, this has largely been untapped. As TPM and other operators move to ‘smart pipes’ the potential opportunity to leverage this data is substantial.

Smart networks will deliver a better customer experience, streamline operations and promote higher sales. New technologies are presenting unimaginable opportunities through the sheer volume and richness of data waiting to be extracted from the underlying network. The data collected from these smart networks will provide operators with the where, when and how their customers are using their mobile devices.

TPM can leverage their unique information assets and network ownership. Successful execution will yield significant opportunities and will add meaningful value to an evolved internet value chain; the result of this will be bigger than the sum of all their parts.

The Internet of Things (IoT) has been a buzzword for many years; however, the opportunity remains largest for telcos. The rise of smart things (apps, wearables, intelligent tools, interactive trackers, autonomous vehicles, etc.) allows companies to compete on functionality and performance while making our lives more interactive.

The connected ecosystem is shifting telcos from a role within the value chain to becoming the value. Convergence is king, and the result of technological advancements is moving the industry from operating dumb pipes to smart ones.

Key Concerns

Identifying the industry headwinds and key business risks are necessary when trying to gain conviction. For us, the key challenges to gain comfort on are:

- The NBN and its economic impacts;

- Mobile network requirements; and

- Adequate spectrum.

A short-term horizon would preclude investors from owning a telco given the margin compression and near-term negative earnings growth. For us, the impact of the NBN is well known, and we believe TPM is well placed to adapt their organisation to the changing context. By having a long-term focus, TPM will harvest the rewards of improved returns and gain significant cost advantages.

As a long-term investor, we believe TPM will generate earnings growth on a 5-year view and that any medium-term (negative) share price reaction presents an opportunity to buy this quality business at a better price.

For us, the primary concern is execution. TPM has previously deployed DSLAM infrastructure (physical equipment) into telephone exchanges, connected fibre to buildings, and pre-configured equipment to the respective sites. To date, TPM’s management team has demonstrated a dynamic capability to deploy infrastructure, on time, while achieving an adequate return on capital.

TPM’s track record of execution gives us conviction around their ability to roll out their mobile network to budget. We have no evidence to suggest management cannot, or will not, deliver a quality mobile network. Our research indicates the cost to roll out mobile technology is materially cheaper than prior technologies, and the majority of costs lie within the fibre deployment (a sunk cost for TPM).

For operators needing more backhaul, fibre is not only expensive to deploy, but the vast re-wiring of networks and extending fibre to the outdoor cells can mean this process is cost prohibitive. For new fibre deployment, this must be completed in a timely, cost-effective manner, and the contractual arrangement between TPM and VHA to deploy their fibre gives us confidence in TPM’s competency.

Finally, the spectrum was a lesser concern for us given the ACCC’s keen interest in promoting a fourth entrant. Rarely does a regulator become a tailwind for an investment, and today these concerns have been quashed given the auction outcomes. See section below.

A Talented Management Team

Central to our investment thesis is David Teoh and his management team. Over time, the board and the management team has made careful, strategic decisions that have generated substantial shareholder value over the long-term.

To quote the former Optus CEO, Kevin Russell,

“Lots of operators in the marketplace only trade from quarter to quarter but David has had a clear, long-term vision for a long time… [Teoh] clearly has strong ownership of the business, which has made the decision-making process in TPG nimble, sharp and uncompromised. That is a big advantage against the bigger players [who] still have to contend with bureaucracies and overseas shareholders.”

TPM has successfully integrated several acquisitions, they’ve demonstrated purchase price discipline, and have executed a long-term business strategy that combined their infrastructure resources, large customer base, and their organisational learnings to deliver a low-cost, high-quality network.

TPM has shown strategic prowess since listing on the ASX. The company began through a reverse takeover of SP Telemedia, which combined Soul, Chariot, and TPG under a single entity. The strategic establishment of the company set the tone for the style of business acumen that was to follow.

Their acquisition of PIPE Networks was the second milestone and provided control over their fibre optic network. Further, the complimentary purchase of AAPT gave control over an 11,000 km fibre-optic network which also enhanced the company’s position as an “increasingly major force in the telecommunications market”. These were the foundations for Australia’s next best telco.

With much of the infrastructure in place, Teoh sought additional scale by purchasing Australia’s largest ISP, iiNet. This transaction catapulted TPG to be Australia’s second-largest ISP by customer volume. Second only to TLS.

A Merger of Equals

This brings us to the recent announcement — the ‘merger of equals’. TPM and VHA announced their intention to bring together their portfolio of fixed and mobile products (MergeCo). MergeCo brings together more than 27,000 km of fibre networks, alongside a mobile network with over 5,000 sites.

The MergeCo will have highly complementary network infrastructure and significantly enhanced scale. MergeCo will leverage cross-selling opportunities and rationalise any duplicated back-end costs. TPM’s discipline and execution, combined with VHA’s balance sheet and global brand reach, present a serendipitous transaction.

The announcement highlighted the value-created to date regarding the clear infrastructure synergies, and for many would de-risk the investment thesis around balance sheet capacity and no need for fresh equity capital.

At first glance, the unequal equity structure suggested TPM was being taken over; however, we believe this structure comes down to the treatment of VHA’s substantial tax losses. The benefit of the VHA entity maintaining majority ownership will result in billions of dollars of favourable tax treatments.

Distinctly, separate to the merger, TPM and VHA agreed to establish a JV (Mobile JV) to secure spectrum in the 3.6 GHz auctions. The JV’s scope may be extended to future spectrum acquisitions and the potential for shared network infrastructure — a move the government didn’t predict.

MergeCo presents a compelling investment case, one that is bitter-sweet for us given our original investment thesis was built upon the opportunity for TPM to bring the entire industry down to their pricing profile which would see substantial returns for TPM, yet suppress the excessive margins enjoyed by incumbents. The impact would have been of biblical proportions.

What Does the Regulator Say?

The ACCC has long advocated for a fourth mobile operator, and the recent developments appear to put that view in jeopardy. The industry is converging, and operators will no longer be in fixed or mobile silos. The merger of the third and fourth largest telcos (by revenue) may see some level of regulatory intervention, and the deal doesn’t seem as simple as some might suggest.

The Chair of the ACCC, Rod Sims, has noted that the regulator’s focus remains on “whether consumers are likely to pay more or receive lower service levels because of the merger” with the key focus being around the level of influence by TPM’s mobile network and the effects on competition for VHA’s entry into broadband.

TPM’s (standalone) network appeared to provide significant benefits to consumers, and one would have to ask the question, “would TPG’s offering provide better benefits to consumers than the merged entity?”. We would expect prices would be lower with TPM as a fourth player, and we’d imagine a fresh, integrated network would provide superior QoS.

To the contrary, the ACCC has acknowledged earlier in the year that an integrated player, like MergeCo, would provide a strong competitor to TLS and Optus and would result in better consumer benefits. Given the barriers to entry from the high-cost of delivering services, the view is that a substantial third player is better than a weaker third and fourth — a valid argument. However, we remain comfortable if TPM continues on their own.

The merger was unanimously backed by TPM’s board, is yet to be approved by regulators and still requires shareholder approval. For us, our investment thesis will need to be reassessed upon approval and will need a new evaluation of the immediate industry dynamics, merger dynamics and synergies, the future rollout, and the respective competitive and execution risks.

On the Spectrum

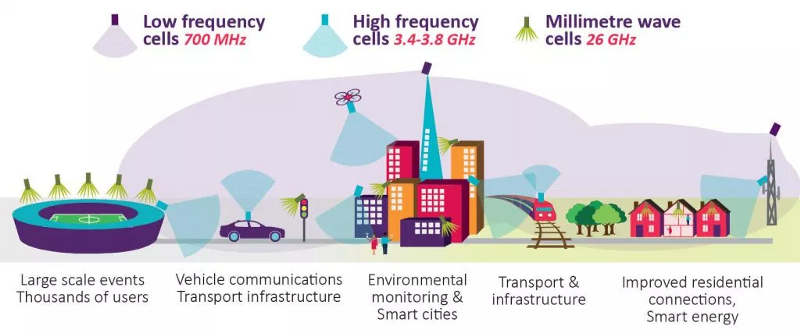

Without going into too much detail about spectrum, we outline the different bands of the spectrum, why they’re required, and who holds them. With the advent of 5G, the ‘usual’ low-frequency bands up to the higher millimetre bands are used to deliver seamless connectivity. The ability to draw on all types of frequency is what makes 5G different.

- Low-Band (Under 1000 MHz)

- Mid-Band (1000 Mhz to 3.4 GHz)

- High-Band (3.4 GHz to 3.8 GHz)

- Millimetre Band (26 GHz and above)

The low-band frequencies travel farther and penetrate buildings deeper (or propagate better) than higher frequencies. It is for traditional mobile services and will be the backbone of the Internet of Things (IoT), industrial automation, and other small data requirements.

The high band provides capacity allows substantial data to be transmitted, quickly. The mid-band is a combination of both, however, having combined low and high band spectrum provides superior outcomes.

The millimetre band has not been auctioned off yet, with the ACMA expecting this band of frequencies to be made available in 2020. These ultra-high frequency millimetre waves will significantly increase capacity and speed for 5G networks.

5G Ecosystem

But Who’s Holding?

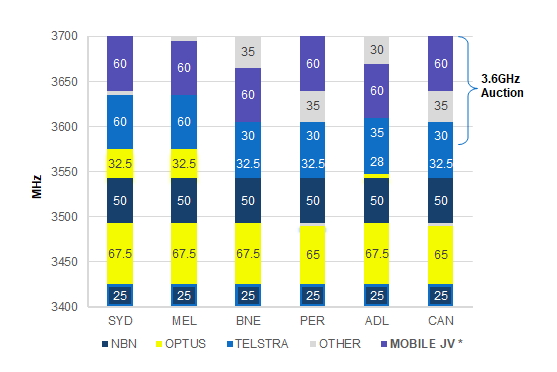

Today, the results of the spectrum were announced with Mobile JV (TPM/VHA) and TLS receiving near full allocations. All 350 lots were sold for approximately $853m. Mobile JV acquired 131 lots for $263m, TLS purchased 143 lots for $386m, and Optus took 47 lots for $185m. Optus was restricted from bidding in certain auctions due to (substantial) prior holdings.

3.4–3.6 GHz Metro Spectrum Holdings

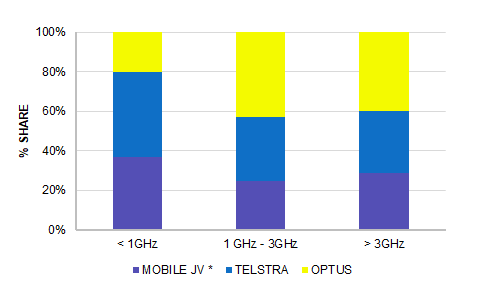

When we look across the board, the allocations appear somewhat comparable with each telco having individual strengths. TPM has the desirable low-band spectrum and has the second-largest holding to TLS (just). Low-band is much better for sending signals through congested city areas, and this will form a strong base network.

In the high band, the ACCC highlighted that 40 Mhz of the spectrum is required by an operator to ‘realise the benefit’ of 5G services and that the optimal allocation is 60 Mhz. Mobile JV achieved a full allocation of 60 Mhz in all metro cities, except Adelaide and Brisbane, where it acquired 50 Mhz. The 3.6 GHz band is known as a lead band for 5G which delivers high speed and greater capacity.

Total Metro Spectrum Holdings

For us, TPM now has an adequate amount of spectrum to deliver a high-quality network. To date, VHA has an extensive macrocell network, and TPM is aggressively rolling out its small cell network. When combined, MergeCo’s infrastructure presents a formidable competitor to TLS and Optus.

The Fibre Factor

For TPM, timing appears to be perfect as they have the fibre factor, they now have large swathes of spectrum, and they have a large customer base. The wealth of data at TPM’s disposal and their opportunity to exploit this is further assisted by a strategic and efficient management team.

TPM’s (individual) opportunity is unique as they can design their mobile network from scratch, without any legacy issues, and in a cost-effective manner that delivers superior services. If complemented by VHA, the scale and power behind the MergeCo essentially de-risks the value proposition and accelerates the competitive timeline with TLS; however, this might be at the expense of VHA, today.

TPM is the only operator to have a clear, defined vision of where they are going; and this vision leverages everything off their fibre infrastructure. Globally, the playbook is written for low-cost operators, with a 20% market share seeming to be low hanging fruit (and incredibly profitable). If we combine this with VHA, it has the potential for market shares to be re-allocated.

Quality Outperforms

In most instances, large capital-intensive industries resist major change; however, telcos have been brought to a critical juncture. The convergence of technologies presents a compelling opportunity for those willing to embrace it. Bold operators like TPM have an unprecedented opportunity to transform themselves with new capabilities that stand to cut their costs and increase their revenues while building decisive advantages over their less ambitious competitors.

Teoh and his team has a strong track record on execution and outperforming investors’ expectations. The investment community’s distaste for telcos from the impending margin crunch has led to a misguided belief that TPM has mispriced their mobile network rollout and that the fundamentals of this quality business have been overshadowed.

By understanding TPM’s core capabilities, their sustainable competitive advantage, the opportunity and the technological shift, we take comfort in the long-term opportunity. When combined with a healthy dose of trust in a capable and respected management team, we stand by our convictions that TPM will outperform over the long-term and will become Australia’s leading telco.

The article has been prepared by ECP Asset Management Pty Ltd (ECP). ECP is a funds management firm based in Sydney, Australia. For further information visit www.ecpam.com. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for financial advice. ECP and the analyst own shares in TPG Limited. ABN 26 158 827 582, AFSL 421704, CAR 44198.