A Value Story from a Growth Investor

How Governance considerations lead to the mispricing of Catapult

Catapult Group International Limited (‘Catapult’) is the world’s leading provider of player analytics solutions. The business provides elite sports teams access to a technology stack that improves athlete training, recovery, team strategy and management solutions. In the highly competitive world of elite sport, every inch counts, and Catapult enables teams to become much more quantitative about how they train and compete.

The business has three divisions: 1) elite video, 2) wearables and 3) prosumer. The elite video and wearables businesses are the most material, with the newly established prosumer division providing some optionality down the line. The wearables business is focused on strength and conditioning which allows teams to track thousands of data points per second per athlete, and use this data to help improve training and recovery. The video business is focused on the coaching staff and provides tools to assess games visually, helping coaches improve training, game tactics and strategy. The marriage of these solutions breaks down traditional operational silos and provides an unbelievable tool-kit to the professional sports organisation. It’s no secret why so many of Catapult’s clients have won Championships the world over.

The business model for Catapult is relatively simple. Both divisions sell access to their services on a capital and a subscription basis. Annualised Recurring Revenue (‘ARR’) for the business as at the half-year was ~$57.4m [1], split equally between video and wearables. Consensus forecasts have the business earning $90m for the full year 2019 [2].

We invested in Catapult in 2014. Our hypothesis being that Catapult was the leader in a large addressable market which was severely underpenetrated. The company’s intention of increasing the recurring revenue by shifting to a subscription model made sense to us, and the optionality provided by leveraging their data set to build out other products like the prosumer offering meant some additional upside. In 2014 we believed the major risk to the business was their ability to execute; today we see the major risks being Governance related as the business attempts to finalise its transition away from being a private company to a public company.

Purpose of this article

The purpose of this article is to highlight that despite the company having a decent product and an open runway ahead of them, the quality of their execution and some decision making has been left wanting.

At its peak, Catapult had a market capitalisation of approximately $650m. Since that point, the valuation of the company has declined, despite some of the operating metrics trending in the right direction. The market is significantly undervaluing Catapult; at the time of writing it was capitalised at approximately $170m. We believe that this is significantly undervaluing the business.

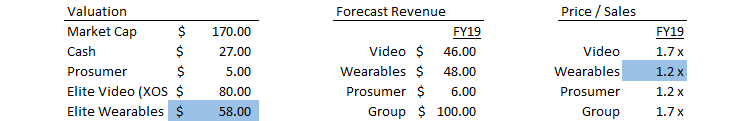

The easiest way to highlight this is to backsolve the value of the wearables business given some inputs. The market capitalisation of $170 million and last reported cash on balance sheet of $27 million[3] are givens. We make the assumption that both the Prosumer and XOS divisions are valued [4] at what Catapult paid for them [5]. Deducting these from the market capitalisation, we can see that the implied valuation for the Elite Wearables business is A$58 million. This means that the market is pricing the Elite Wearables business at roughly 1.2 times forward sales.

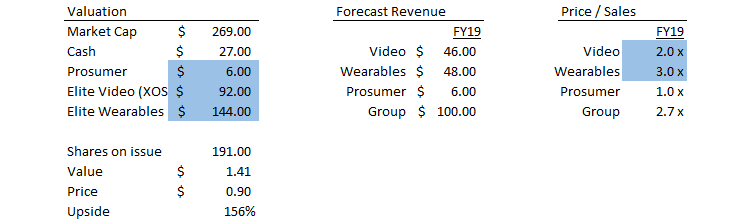

If we were to apply a reasonable (yet still undemanding multiple) of 2 times sales for the video business and 3 times sales for the wearables business, we get a valuation of $270 million or $1.41 per share; which is 156% more than what the business is currently trading at. Most software companies with recurring revenue that operate in a global market trade in the range of 4–6 times sales. Where they sit on this range is largely dependent on their gross margin, and the runway available to them. Catapult has a very high gross margin, and is still significantly under penetrated, implying that it should be on the higher end of that range — implying more upside than we’ve stated.

We believe the market is mispricing Catapult for the following three reasons: Firstly, the financial performance of the company hasn’t met expectations. Secondly, the company has had issues with executive retention and alignment. Finally, there are a few remaining Governance issues which need addressing. The current status of these issues is not reflective of what is expected by a publicly listed company.

Financial performance of the company

As companies grow, they face a number of issues. Generally, the challenges for growth companies are centered around maturing their people, processes and structures to provide a stable foundation for the business to scale efficiently. Post ‘seed stage’, the challenges faced by a company are more about scaling profitably than about revenues, as there is usually demand for the products. The revenue and profit pools need to be unlocked efficiently.

In order to assess the progress of an investment, we use accounting measures to benchmark our hypothesis. Revenue is generally reflective of the fit a product has with the needs of the end customer. In the purest sense of the word (ignoring revenue recognition policies), the revenue line is driven by the demand for the product or services. In contrast to this, everything below the revenue line is a reflection of a number of management decisions. The quality of those decisions directly impact the business and all its stakeholders, and so it’s worthwhile to examine them to see how well management have been performing.

There is clearly demand and a large runway for Catapults products

Catapult has grown its customer base by four times to ~2,000 teams. At the most full year result, the business had grown revenues eight times to ~$76m and had increased Annualised Recurring Revenue (‘ARR’) to ~$53.4m [6] through acquisitions and organically. Based on the total addressable market (‘TAM’) defined by the company [7], Catapult has reached a 12% market penetration, indicating that there is still a significant runway for further growth.

The company has made sound strategic decisions

What was not clear to us when we originally invested, was that there were silos between the coaching and strength and conditioning staff. Coaching staff are more tactical and focus on video. Strength and conditioning are more player focused and rely on data. As head coaches are usually involved in the purchase decision, and are more tactically oriented, it was relatively difficult to penetrate the market until coaches saw the value in wearables. By acquiring XOS (video), Catapult could improve the sell through rates of the teams who didn’t understand wearables by selling video first.

But hasn’t shifted to subscriptions fast enough

The business’ core product, the elite wearable division, is the bread and butter of the organisation. The decision to tilt the business to a subscription based model made a lot of sense to us, given the improved capital efficiency of a subscription model as opposed to a capital sales model.

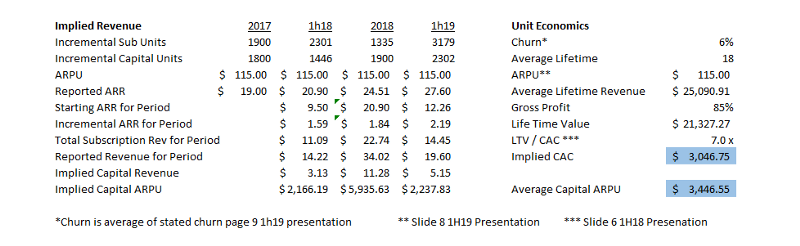

To illustrate this, we break down the unit economics using information presented by the company. Using the provided LTV/CAC, Churn and ARPU numbers we can work out the unit economics, with a particular focus on the cost of customer acquisition. We compare this cost to the implied cost of a capital sale to see if the company is generating enough value from capital sales, to warrant them continuing down this path.

We can see that, despite getting a larger cash component up front for a capital sale than a subscription sale in year one, we are getting a marginal contribution to the business from each capital sale net of customer acquisition costs. Additionally, we are not guaranteed that the capital customers will purchase again with Catapult, and so we have to effectively re-target them to move them to a subscription, or resell them another capital unit, incurring further acquisition costs [8]. This compares with having sold a subscription for a cost of three thousand to a lifetime value of twenty thousand, assuming that churn rates are maintained.

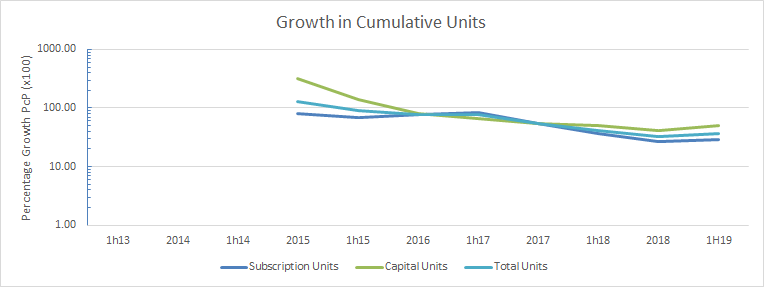

If we compare the growth in cumulative subscription and cumulative capital units against the growth in the overall unit base, we can get a sense of where the company has been successful. As we can see, the growth in capital sales has been exceeding the growth in subscription units in each period since listing, with the exception of 1H17. This says to us that the company has been making primarily uneconomic capital sales.

Their push into prosumer was too fast and too early

Originally the company had stated Prosumer was a long horizon growth objective. While it wasn’t explicitly stated when it would occur, our understanding was that once the company had more fully penetrated the elite wearables space, they would leverage their position to move into the prosumer market. Consumer facing markets tend to be more competitive and have lower margins. Diverting funds and focus away from a higher margin under penetrated market towards a lower margin, more competitive one, only made sense when the elite market was starting to mature. The company brought it’s entrance into the prosumer market forward with its acquisition of kodaplay and the launch of PLAYR.

To the company’s credit, the launch of PLAYR was relatively successful. The product is very impressive, and has shown some commercial promise generating revenues of A$2.7m at the half. Additionally, the company has learnt a lot about product design and marketing, which they’ve leveraged into their new vector product which is a step above their current offerings. It is debatable whether or not the company needed to launch a full blown product to get these same research insights, and could very well have received similar insights and learnings for the overall group having spent significantly less money.

Based on recent company filings, we expect that the prosumer division will make an operating loss of approximately $7m for the full year.

Accordingly, profitability has been elusive

Reported underlying EBITDA has only been marginally positive on a reported basis since 2017 and on a statutory profit basis it has never been profitable. All else being equal, if it did not have the prosumer division, it would have had an additional $20 million [9] to spend on sales, marketing and R&D for its core product suite. Looking forward, we estimate that the company would, based on consensus numbers, be expected to make an underlying EBITDA at least 10 million for the full year 2019 without any spending on the prosumer division. If Catapult were able to shift the capital subscription mix, there would have been further additional free cash available to the firm over time.

Overall, the sub optimal capital allocation decisions by the Board has meant that firstly, the company has raised more capital than they probably should have. Secondly, they have had to employ a sub optimal incentive scheme. All of which have delayed profitability and diluted shareholders.

Governance and incentives

We have engaged with the company on a number of occasions regarding a range of issues, including:

- Executive Share Sales;

- The implementation of structures around incentive payments;

- Improving the transparency of reporting structures; and

- Executive turnover.

We do not wish to cover topics that have already been addressed by the company, and welcome their efforts to implement the suggestions of their shareholders. However, there are two key issues for us that still need to be addressed and we will discuss them briefly here.

Executive alignment

While Catapult has managed to attract some very good top level talent, the company has also experienced significant turnover in these ranks. The recent appointment of Mark Hall (CFO) and Joe Powell (CEO) marked, for us, the start of a regime in which Catapult would mature into a world class business. They matured internal business processes and improved reporting transparency. Unfortunately, the pair also announced their resignations from company within a few months of each other. We have been trying to understand why this is the case; a lack of detail around this from the company means we have to make our own inferences which we outline below.

In order to attract and retain the kind of talent required to execute on the vision for Catapult, the company has employed an employee incentive scheme. This can either be done via an options scheme (‘EOS’) or by through an equity scheme (‘EES’). The key difference between the two, is that under an EOS, the company does not have to outlay any cash, and employees can get leverage to the share price if the price is above the strike of the options. Under an EES, the company has to buy the shares and then provide them to the employees. The company needs to buy these shares initially, and then the employee shares in the value of the equity and dividends through time.

The problem with an EOS has been highlighted recently through executive departures — an options arrangement is asymmetric in its payoff. At the current share price, the majority of the options on issue are at risk of expiring worthless, and so, the Executives may not ascribe any value to those incentives. We believe an equity incentive scheme would be more appropriate to ensure that the executives have some value even in the face of poor share price performance. The focus of Executives will then be less about getting the share price above a certain value on a given date, and more about building a long term sustainable franchise.

In our experience, when the soft issues (culture, business performance, work environment, and opportunities) are there, monetary factors become secondary motivating factors. When these soft factors are missing, people tend to seek an increase in monetary compensation. The most recent CEO and CFO were annualising cash salaries of approximately $500,000 and $300,000 [10] respectively [11] with performance incentives of roughly double their cash components. These numbers are relatively large for a company of Catapult’s size and suggests to us that their departures were not solely about compensation.

The opportunity is large for Catapult. It’s a very exciting company, working with some of the most recognisable brands in the world. The company is performing reasonably well, and so for us, it feels that perhaps the executives may not have felt that they were able to contribute in a way that meant they wanted to initially. The number of executive members on the board, who are involved operationally, provides further weight to this assertion.

Board compensation and composition

In his final submission to the recent Royal Commission to the Financial Services Sector, Commissioner Hayne spoke about the role of the board and directors duties. He said that ‘Boards can not, and must not, involve themselves in the day-to-day management of the corporation’ [12]. He also said that the task of the board is overall superintendence of the company, not its day to day management. An integral task is being able and willing to challenge management on key issues. To do this effectively, they need to be distanced enough to be able to assess objectively.

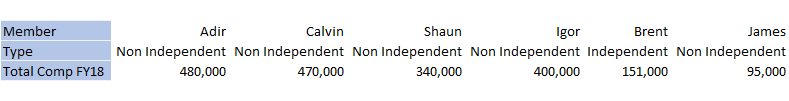

Only one of the six members on the Catapult Board is independent. Two directors co-founded the business and have since transitioned out of the business. Four of the six members of the board are significant shareholders and account for up to 30% of the register. Firstly, the composition of the Board does not comply with the ASX Governance Guidelines, and most importantly, we believe that management would find it very difficult to operate freely under a board with such a vested interest in the company.

According to Bloomberg data, Catapult is in the top 3% of Companies in the ASX 300, for aggregate Board member compensation, normalised for revenue. Additionally, we note a large discrepancy between Independent and Executive members on the Board. Prior to the appointment of James ‘Jim’ Orlando to the role of interim CFO, the average total compensation for an Executive Director is A$422,000 and the average total compensation for an independent director is A$123,000 [13]. Why is there such a discrepancy?

In the 2018 Annual Report, Catapult Director Brent Scrimshaw commented that “over the medium term it will be appropriate to review the composition of the Catapult Board. We anticipate an evolution of the Board composition to address the diversity and skills mix appropriate for the next phase of growth of this ambitious, listed sports technology business.” We agree with Mr Scrimshaw and believe that the time has come to update the composition of the Board.

Conclusion

We firmly believe in the potential of this Company to win a substantial portion of the market and create significant value for its shareholders. In order to do that, the company needs to improve the Governance, address the Executive retention issues and ensure that the CEO and management team are able to focus their attention on the most profitable parts of their business. We firmly believe that if steps are not taken to remedy this, the company is at risk of further staff departures, and potentially further value destruction for shareholders.

In our recent discussions with the company, we made suggestions on the following lines:

- Board Composition and Remuneration;

- Modify incentive structures to better align and retain key management personnel;

- As a matter of priority, appoint CEO and CFO for the business. Our preference was internal candidates to promote succession planning and stability.

- Refocus the business on the more profitable segments.

If this is done, we believe that there will be a material re-rating of the company by the public markets. We again reiterate firstly, our desire for the company to consider these as a matter of priority and secondly, our willingness to work alongside the board to ensure that the most value is created for shareholders.

References: [1] 1H19 Presentation, Page 5. [2] Bloomberg. [3] Page 12 Appendix 4D for the Half Year ended 31 December 2018. [4] Catapult has invested significant sums in internationalising xos and cross selling it to other sports. Prosumer has started to generate revenues. [5] Catapult acquired XOS for A$80.1 million and KodaPlay (PlayerTek) for A$4.9m. Source: Company Release 13 July 2016. [6] Page 5 FY18 Results Presentation [7] Page 24 1H19 Results Presentation [8] Our assumption here is that the acquisition costs, on average are the same regardless of what the end customers chooses — either a subscription or capital sales.[9] Total Prosumer opex of E$17m, acquisition price of A$5m. Source: Catapult financial releases. [10] Mark joined catapult in 1 November 2017; as at 30 June he had worked 67% of a year. Grossing up his stated cash salary for that period comes in at 300,000. [11] Page 25 Appendix 4E for the full-year 30 June 2018. [12] Volume 1, Chapter 6, Page 400 — Final Report: Royal Commission into Misconduct in the Banking Superannuation and Financial Services Industry. [13] Page 21 Appendix 4E for the full-year 30 June 2018.

Disclaimer: The article has been prepared by ECP Asset Management Pty Ltd. ECP is a funds management firm based in Sydney, Australia. ABN 26 158 827 582, CAR 44198 AFSL 421704. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for financial advice. ECP owns shares in Catapult Group International Limited. For further information visit www.ecpam.com.