The early innings of enterprise cloud software

A structural driver for the next decade

Enterprise software is in the midst of a structural shift toward cloud-enabled platforms. In-house systems, localised IT teams, unsupported third-party software, and expensive solutions by incumbents present a major market share opportunity. The legacy moat attributed to customer stickiness and high switching costs has ended. We are now witnessing an inflection point, driven by several technology evolutions, which will reward new and innovative players. We discuss one of our recent portfolio additions that is well positioned to capitalise on this trend.

The Problem

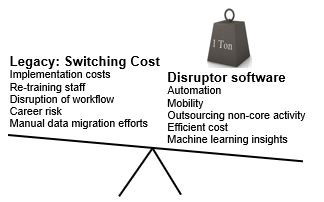

For decades, legacy software has survived in enterprise markets due to high switching costs. Justification for enterprise apathy to switch core system software in many industries includes: expensive migration processes, disruption to employee productivity, retraining requirements, impacts to customer experience, and executive dismissal if implementation goes wrong.

The life and health insurance industry is a prime example. Eastbridge Consulting found that 54% of the industry use legacy home-grown software that was installed in the 1970s and 1980s running on IBM mainframe written in outdated code (i.e., COBOL). Further, 31% run third party software no longer supported, and 15% are using point solutions built in the early 2000s that are no longer supported.

As decades have come to pass, problems maintaining legacy software have grown to become quite a long list. Some of our favourites include:

- Unstable IP restricting innovation. Keeping legacy systems requires continuous management of old IP integrations with multiple front-end point solutions. This problem is compounded by decades of piecemeal software build and industry consolidation resulting in numerous different legacy systems with multiple databases, and numerous developer teams trained in different code types, no single-source client data, and required system changes (e.g., new products or changing regulations) prove onerous for each individual system.

- Shrinking access to development talent. It is increasingly difficult to attract developers to work on old, out-dated software architecture/code, either from a skillset or interest perspective. For example, the number of developers trained in COBOL language continues to reduce, and those left are approaching retirement.

- Increasing costs and lost employee productivity. Expensive maintenance projects are required to self-support outdated software to adjust for new products or new regulations. Further, re-keying data across different systems and lack of automation in workflow drive unproductive staff through inefficient practices.

- Inability to leverage data. These legacy systems provide fragmented access to client information through sub-optimal data structures, which limits the ability for managers to conduct analytics, apply modern machine learning tools or build value-added applications to generate insights.

- Focus on non-core activities. On-premise software management requires clients to be responsible for non-core IT planning and budgeting which present a drain on management bandwidth and company resources which could be better used to serve clients.

- The fact that legacy software has survived so long indicates that the incentives for companies to switch was never compelling enough.

Times Are Changing

The benefits of disruptive enterprise software now outweigh the apathy of enterprise management teams when faced with the prospect of switching.

Three structural trends have amalgamated to create a compelling reason to switch:

-

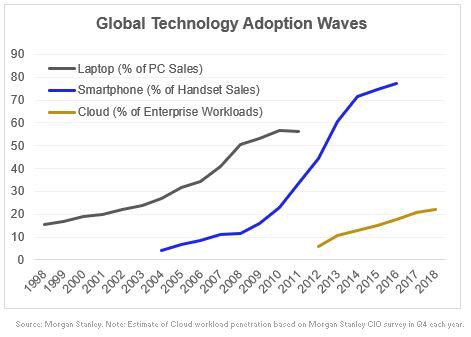

Mobility became prominent in the 2000s with the adoption of laptops, and further accelerated with the penetration of the smartphone. To serve the demand for employee mobility, software frameworks evolved, separating the data model, controller model and view model into separate components. This allowed varying applications the capacity to give customers and employees the ability to work or be served, anywhere, from any device, any time.

-

Public Cloud has seen radical adoption over the past decade, but is still only 20–25% penetration of enterprise workloads. It gives tangible cost benefits to enterprises which are no longer responsible for implementation or maintenance of hardware and software which was historically managed internally, or outsourced to expensive professional service implementers. Performance, scalability and up-time are hard problems to solve that have little to do with the core competency of an enterprise. These non-core activities shift to the software vendor, and enterprise management focus is redirected toward client value creation. Cloud software reduces adoption friction by reducing upfront costs and allowing pricing to be tightly correlated with software consumption.

-

Machine learning is increasingly becoming a major structural trend. Enterprises with modern software and the ability to capture structured data on operational, client and employee activity are increasingly leveraging data science tools to gain proprietary insights that increase competitive edge and unlock economic value (e.g., dynamic pricing). Machine learning is only as powerful as the quality of data that the algorithms are fed. Enterprises with modern architecture, data capture and storage capability are best positioned to leverage these tools, and will have a substantial competitive edge over their late-adopting competitors.

FINEOS — Insurance Enterprise Software

FINEOS Corporation (ASX: FCL) is a recent portfolio addition that is uniquely positioned to capitalise on this structural trend. The company sells software for core systems (policy administration, billing, absence and claims management) to enterprise-grade insurers in the Life, Accident and Health insurance market.

After decades of relentless R&D investment, FINEOS has reached a position of product leadership with few viable competitors. First mover advantage has resulted in advanced traction with tier 1 North American insurers for new product modules, creating a superior brand advantage.

With product development mostly completed, we expect FINEOS to enter the sales harvesting phase of its life cycle with a significant runway for revenue and margin expansion. We expect the current pipeline will continue to grow substantially and their $100 million revenue to more than double within our five-year time horizon.

The company is founder-led, supported by a senior executive team that has been together for over twenty years, and we have high conviction in their ability to execute its long-term strategic vision. For us, FINEOS presents a unique investment opportunity taking advantage of this paradigm shift.

Opportunity Ahead

Valuing the potential of investments begins with identifying industries that provide for long-term growth — a paradigm shift presents an extraordinary runway. At ECP, we believe significant outperformance will be generated over the long-term by investing in disruptive software leaders with strong competitive advantages looking to penetrate this opportunity. We are excited by the potential of the companies we own and by the new opportunities we continue to uncover.

The article has been prepared by ECP Asset Management Pty Ltd (ECP). ECP is a funds management firm based in Sydney, Australia. For further information visit www.ecpam.com This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for financial advice. ECP and the analyst own shares in FINEOS Corporation Ltd. ABN 26 158 827 582, AFSL 421704, CAR 44198.