While we are not qualified to assess the humanitarian impact of the virus, nor can we say how long the whole situation will last, we thank the medical and scientific community for their efforts in trying to solve the problem and caring for those impacted. We also acknowledge those leaders in the world who are providing rational, clear guidance to maintain the safety of the population.

As was the case during the GFC in 2008, investors quite correctly are concerned about the recent volatility in the public markets and the impact this has on the future value of their investments. Unlike the GFC, the current panic that is evident in the investment markets has been fueled by the forecasts and predictions made in the media by various “experts” on the likely impact of the virus. It seems that it has been forgotten that on many occasions, the expert forecasts which caused the pandemonium turned out to be totally incorrect. The best known of these massive errors in judgement were Y2K and the Club of Rome oil predictions.

The Y2K Scare or “Millennium Bug” occurred at the turn of the 21st century when it was feared that computers would stop working on December 31, 1999 causing massive disruption to Banks, Insurance Companies, Hospitals, and Government Departments. The problem arose in the 1960s and 1970s, when engineers used only two-digit codes to represent the year to save on storage space which was very costly at the time. When the millennium rolled over, systems remained intact. However, the point is that many institutions spent billions of dollars and countless hours on the problem in an attempt to avert the risk which never materialised.

Another illustration of experts getting it totally wrong was a report for the Club of Rome, called “The Limits to Growth”, which was written by a team of researchers at MIT in 1972 and based on a computer simulation of exponential economic and population growth with a finite supply of resources. They attempted to model the interaction between earth systems and human systems and concluded that petroleum would run out after 31 years with world reserves depleted by 50 billion barrels by 1990. In fact, by 1990 unexploited reserves amounted to 900 billion barrels — not including the tar shales where a single deposit in Alberta contains more than 550 billion barrels. In times of crisis human ingenuity and resilience always comes to the fore.

Ensuring that one’s emotions are kept out of investment decisions is paramount and when the markets overreact to these predictions, what is certain is that Armageddon does not occur. The closest the world financial system came to total collapse was during the GFC when cool heads and steady hands averted a total disaster. During the SARS (also a Coronavirus) outbreak between February 2003 and July 2003 the ASX All Ordinaries only dropped 5.35% to 2778.4 during February and by December 2003 was at 3306.0 (+19.0%). During the GFC, September 2008 to June 2009 the All Ords moved from 5209.2 to 3937.8 (-24.4%) and by December 2009 it was back up to 4882.7 (+24.0%).

At ECP, our investment philosophy is that the economics of a business drives long-term investment returns. For us, finding high-quality business with strong balance sheets means we are confident to back management to manage presented issues. Markets are also notorious for over-reacting to temporary themes and our long-term approach means we see turbulence as a normal part of the market. In turbulent times we keep a clear focus on the fundamentals of the businesses when navigating the uncertainty presented, enabling us to capitalise on this market feature.

During the past two months, high-quality companies have been marked down along with the poor-quality companies in a complete reversal of the ebullience of the previous year with whole sectors being sold off indiscriminately. For us, understanding the potential impacts of COVID-19 on each company and its ability to grow their economic footprint is of paramount importance.

Our process focuses on investing in high-quality growth businesses, which means that the average price-earnings ratio of our companies through time is normally well above the market average price-earnings ratio. In times of uncertainty, higher PE companies tend to be sold down more heavily than lower-priced companies. The recent stock market turmoil has resulted in debt and equity risk premiums moving to multi-decade highs and once equity markets stabilize, risk premiums will decline to more sustainable levels.

We expect that the average price-earnings ratio of the stock market will expand and push stock prices higher. When this happens, our portfolios will receive a boost from the growth in earnings and the re-establishment of the price-earnings premium that high-quality growth businesses typically enjoy. We don’t know how long the current situation will last, but we can be confident that with a three to five-year horizon great companies will continue to provide shareholder value and it is during these times that a world-class investment process comes to the fore.

Our investment portfolio comprises high-quality, low capital-intensive growth companies that have a sustainable competitive advantage with the portfolio weighting determined by the expected return from the investment as determined by a risk-adjusted Internal rate of return (IRR). In our process, we calculate a five-year IRR for each investment in our portfolio. As a result of combining all the IRRs of the stock in the portfolio we can calculate an overall IRR or expected total return for the portfolio.

The current forecast IRR for the portfolio is currently sitting at around 19.00%. The last time the IRR was this elevated was in 2008, and the subsequent investment performance was strong in both absolute and relative terms over several years. Our investment horizon is longer than most investors, and we believe there is significant capital appreciation potential for the portfolio once risk premiums decline more in line with long term historical averages.

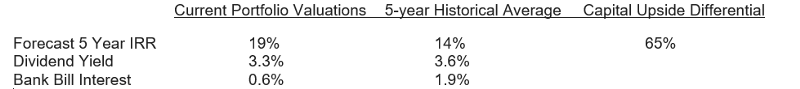

In Table 1 we have attempted to quantify and contextualize the portfolio’s upside potential. All things being equal, if the portfolio IRR was to move from 19% currently to its average over the past five years, the portfolio’s capital value is estimated to increase by approximately 65%. The lower dividend yields, while still above the five-year average are favourable when considered in light of the negligible rate of interest received on cash deposits and as evidenced by the Bank Bill swap rate of 0.6%.

The forward PE of the portfolio is currently at 18x versus 14x for the market. While the portfolio has been sold off in line with the market, we are still holding a premium to the overall market. In the current environment earnings certainty has to be questioned. While we believe the high-quality nature of the companies in our portfolio means that their earnings are considerably less uncertain than the broader market, if we make adjustments to the earnings in the current environment, we would expect that the current market multiple is likely to be closer to our portfolio multiple of 19x than what is currently stated.

Once the market settles down, we believe that it will start differentiating between companies reliant on the economy for growth and those that have organic growth options. Given we are a growth investor, our best performing economic environment is one where the economy is strengthening rather than weakening as it is at the moment. There is not much we can do about this other than making sure that our forecasts have accommodated the earnings downturn. However, if the domestic and global economies should remain under pressure over the next 12 months, our companies will be affected, but less so than the average company, due to the following reasons:

Firstly, when companies face reduced demand for their goods and services, this eventually becomes a liquidity issue as EBIT levels decline and, in some cases, turn negative triggering debt covenants. The companies in our portfolio enjoy low debt levels as a result of our upfront interest cover requirement, with the interest cover on the portfolio >20 times.

Secondly, our portfolios are protected to some extent from deflation. Quality companies possessing competitive advantages in our portfolio are in a better position than the average company to maintain pricing levels. Additionally, our businesses are not capital intensive. They are able to better use their funding sources to trade through these tough times.

Thirdly, our portfolio is oriented towards businesses in the growth phase of their life cycle that are not solely reliant on the economy for growth. In times where consumption shrinks these businesses have shown an ability to expand their market share. The combination of high returns on invested capital and organic growth models, our businesses do not rely on cheap debt or equity to take advantage of these growth opportunities.

The portfolio return profile is more attractive than any other time since the GFC. Our current expected return for our all cap portfolio is forecast at 19.00% per annum over the next five years. This compares with an average forecast five year return of 14% per annum. Interestingly, on a realised basis the portfolio has delivered returns of 13.00% with 5.10% alpha since ECP was established seven years ago. NB. This return profile is consistent with the profile generated by the strategy over the past twenty-two years returning 12.5% with 4.0% alpha per annum.

The article has been prepared by ECP Asset Management Pty Ltd (ECP). ECP is a funds management firm based in Sydney, Australia. For further information, visit www.ecpam.com. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for financial advice. ECP and the analyst own shares in IDP Education. ABN 26 158 827 582, AFSL 421704, CAR 44198.