We have a saying at ECP, ‘sleep well before eating well’. As a high conviction fund manager with a focus on capital preservation, we need to sleep at night knowing our portfolio companies have capital structures built to withstand all economic conditions. In this piece, we explore our portfolio balance sheet strength at a high level, and dive deeper into Afterpay with a potential recession ahead of us to test its credit model.

Quality Outperforms

Our investment philosophy is based on the assumption that the economics of a business will drive shareholder returns over the long-term. Our strategy is to build a portfolio of quality franchises which are able to expand their economic footprint through time and have a capital structure built to survive all economic conditions. In the eye of an economic storm, growth plans may be halted indefinitely, but a well capitalised business is positioned to weather the worst, then thrive as the expansion continues.

Though our risk assessments are company specific, measuring the debt capitalisation of our companies at a portfolio level demonstrates this philosophy in action, particularly when contrasted to the ASX300.

Due to differences in capital structures we break our All Cap portfolio and the ASX300 into two categories: 1) Lenders & Insurers, and 2) Portfolio (ex-Lenders & Insurers). When contrasted to the ASX300, our All Cap portfolio exhibits lower balance sheet risk across all segments:

- All Cap portfolio has less aggregate exposure to ‘Lenders & Insurers’ at 18% of ECP equities vs. 26% of the Index. The portfolio has zero exposure to insurers.

- The ‘Lenders & Insurers’ we do hold have less leverage, with a 47% book leverage ratio versus the ASX300 at 64%.

- The remaining portfolio (ex-Lenders & Insurers) has less leverage and more exposure to net cash businesses with 45% of business exposure in this category net cash, versus only 13% for the ASX300.

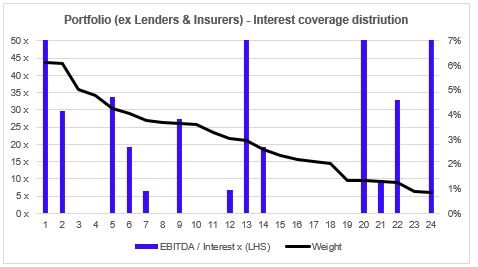

Diving deeper into our Portfolio (ex Lenders & Insurers) which comprises 82% of our equities across 24 holdings, we show the trailing interest coverage ratio (ICR) for businesses which are in a net debt position. The lowest ICR is 6.5x and the weighted average is 44x.

Risk can be defined in many ways. Some investors approach risk from the lens of share price drawdowns, however we prefer to measure risk as the odds of permanent capital impairment. We accept the odds of larger drawdowns in earlier life-cycle growth companies during weak economic environments — assuming the business is sufficiently well capitalised — because we believe our stock selection and investment strategy will outperform over the long-run. One such example of an earlier stage company is Afterpay.

Stock In Focus — Afterpay

While Afterpay has proven the merits of its business thesis, financial model and growth strategy in a normal economic environment, it is soon to be tested in an economic decline.

With the US and ANZ self-containment likely to drive a short-term economic demand headwind and surge in unemployment, investors are concerned Afterpay could soon experience a cliff in customer defaults.

Is Afterpay capitalised to survive?

An underappreciated aspect of Afterpay’s financial model is its rapid receivables repayment cycle (on avg 23 days) with a monthly return on capital of ~4% from repaying customers. This gives it the ability to absorb monthly defaults of 3-4% of each receivables cycle before the balance sheet is needed to absorb a temporary spike in bad debts. With a well capitalised balance sheet and a high monthly return on capital from repaying customers, we believe Afterpay is able to withstand most bad economic scenarios.

Whilst Afterpay’s total cash position is $403 million on balance sheet, this omits cash that has been used to equity fund the receivables balance outstanding, which we estimate is ~$394 million. This brings the true cash position of Afterpay closer to ~$800 million. The utilisation of this cash can be broken in to two components:

1. Cash for receivables financing

As of December 2019, Afterpay had a receivables balance of $761 million. Total warehouse facilities utilised on the balance sheet totalled $367 million, an LVR of 48%. Therefore, Afterpay has cash funded receivables outstanding to the tune of ~$394 million.

2. Cash on balance sheet for operating costs and capex

As of December 2019, Afterpay had $403 million cash on its balance sheet, or $353 million net of the corporate bond due in 2022. In 1H20, Afterpay’s cash operating expenses, plus capex was roughly $120 million. Balance sheet cash therefore exists to fund nearly 20 months of operating and capital expenditures. With marketing expenses ($32 million 1H20) and other costs able to be pulled back, Afterpay would likely pull levers to stretch this cash out longer.

An illustrative ‘bad’ scenario

By focusing our analysis on Afterpay’s receivables funding, we can stress test its financial model. The short duration of the receivables book (23 days) allows us to model the business on a monthly basis, and build a picture of what 2020 could look like.

Our bad scenario makes the following assumptions:

- 40% of customers across the group default between April and August 2020, with intensity peaking around May and June;

- Late fees are cancelled between April and August 2020 as a gesture of goodwill, resulting in zero late fee revenue in the period of maximum bad debt stress;

- In 2H20 we assume the business is split roughly 50% ANZ, 45% US, and 5% UK which guides are assumptions on the average merchant fee (3.85%) and processing costs (i.e., -1.2%).

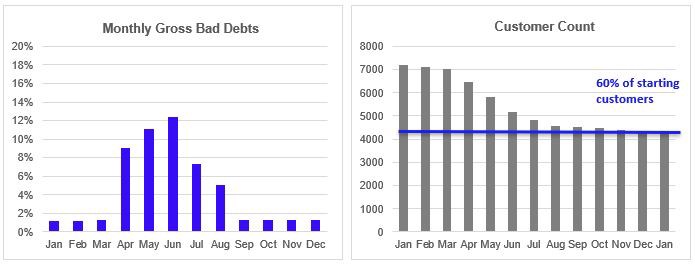

In this hypothetical scenario, monthly bad debts peak above 12% in June and cumulatively 40% of existing customers default by year end, leaving 60% of the original customer base. We assume no new customers added during the period.

In the worst months, net transaction margins fall to -10% as late fees are forgiven and bad debts spike and don’t return positive until September when a major bad debt wave passes.

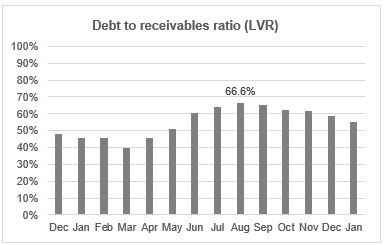

In August, the debt LVR peaks at 67%. Around this point, most customers facing financial hardship due to unemployment have already defaulted, and only repaying customers remain. Thereafter, net transaction margins return positive allowing a rapid deleveraging of the business due to the high monthly return on capital.

Customer defaults do not form part of the covenants which trigger the withdrawal of funding facilities. Instead, high loss rates require equity contributions to keep the facility below the maximum LVR. Our understanding is that banks typically limit receivables facilities to 80% LVR. In our bad scenario LVR peaks at 67% and is well below this threshold.

What if repaying customers spend materially less?

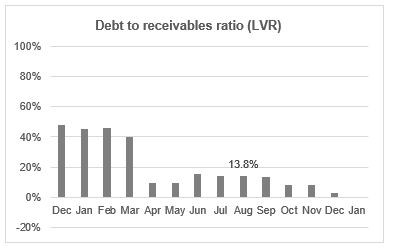

Declining transaction volumes from customers — either due to lower discretionary spending or tighter lending policies by Afterpay to manage risk — would have the effect of unwinding receivables. This would happen relatively quickly given the average repayment cycle of 23 days. The result would be that cash is released from receivables which then de-gears the balance sheet.

To illustrate this effect, if we extend our ‘bad’ economic scenario into a ‘worse’ one by assuming that from April 2020 average monthly transaction volumes per customer fall -40%. In this scenario, whilst revenue would fall, the business would rapidly de-gear as shown in the below chart.

While we’ve demonstrated that Afterpay has balance sheet headroom in a bad scenario, we believe that a number of factors could further improve their position:

- Cash buffer from the group operating costs. Afterpay would have $403 million in cash to fund on-going operations which would support current opex and capex cash burn for 20 months. In a recession, non-essential costs would likely be reduced allowing balance sheet cash to be allocated to the receivables funding if it were needed.

- Changing Australian eCommerce to 25% paid upfront would unlock cash and reduce risk. The average repayment cycle in Australian eCommerce is 35 days given no upfront payment, which compares to 21 days everywhere else (including Australian in-store), resulting in a group average of ~23 days receivables outstanding. Moving Australian eCommerce to a 25% instalment upfront would not only reduce the risk of unemployed consumers making transactions, but reduce working capital intensity bringing the LVR 5% lower immediately.

Is there refinancing risk?

Despite a well funded balance sheet for our (bad) hypothetical scenario, the question remains: is Afterpay exposed to refinancing risk on its committed receivables warehouse facilities?

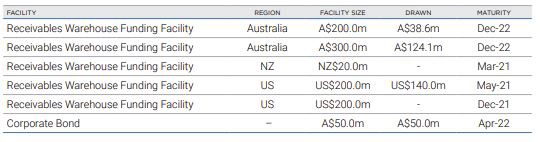

For us, the risk of refinancing appears low. Afterpay currently has low utilisation of its facilities in place, with its longest tenure facilities in each region able to absorb all current funding requirements. Afterpay’s committed facilities aren’t due to expire in Australia until December 2022 and the US facility until December 2021, minimising refinancing risk until this time.

Does a bad year break the investment thesis?

With a strong return on capital from repeat, repaying customers, a ‘bad scenario’ year which sees 40% of existing customers default in a five month window results in a total return of -30% on the receivables invested capital. If only 30% of customers defaulted in the same period, return on receivables capital improves to -7%.

In a normal year, with customer defaults in line with historic trends, return on capital exceeds 30%. If we assume one ‘bad year’ for every seven, Afterpay’s receivables book stands to generate in excess of 20%+ return on capital for a full cycle.

We believe this full-cycle return on capital for the receivables book and global network-effect growth opportunity remains a compelling opportunity for long-term investors. As long as the business is sufficiently capitalised to survive the challenging years ahead, the business will continue to thrive thereafter.

Conclusion

Our analysis on Afterpay is not to suggest our ‘bad scenario’ is a likely one. Instead, we seek to stress test the businesses ability to survive under the worst case scenarios. We believe Afterpay is well funded to weather this storm.

As this unprecedented period of economic shock comes to pass, we are optimistic Afterpay will have proven its ability to control bad debts, and its short-duration financial model’s ability to absorb losses. If our analysis proves correct, a major bear thesis will have been tested, and investors will return their focus to the long-term opportunity that lies ahead.

At ECP we allocate our capital across a diversified portfolio of quality franchises expanding their economic footprint through time. A core pillar of this philosophy is ensuring the business is well-capitalised to survive all economic scenarios. We believe consistent application of our investment process will continue to generate long-term outperformance.

The article has been prepared by ECP Asset Management Pty Ltd (ECP). ECP is a funds management firm based in Sydney, Australia. For further information visit www.ecpam.com. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for financial advice. ECP and the analyst own shares in Afterpay Touch Group Ltd. ABN 26 158 827 582, AFSL 421704, CAR 44198.