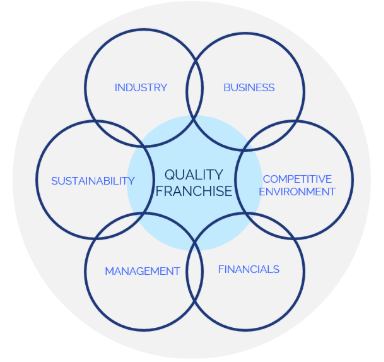

For long-term investing, it’s important to understand both the narrative of an investment and the numbers that support it. Qualitative research provides the grounding for understanding the narrative, however, there requires a clear method of logic and measurability to critically assess and distill the information. The Pillars of a Quality Franchise is a framework that assesses these through balancing factors of quality, growth, and sustainability.

ECP Asset Management (ECP) is a boutique fund manager offering investors a concentrated, benchmark unaware and growth-biased exposure to Australian equities. As a high-conviction manager, understanding the competitiveness and sustainability of a business is paramount, combined with a healthy dose of trust in a proven management team.

Our philosophy is based on the belief that ‘the economics of a business drives long-term investment returns’. We believe that high-quality, growing businesses that have the ability to generate predictable, above-average economic returns will produce superior investment performance over the long term.

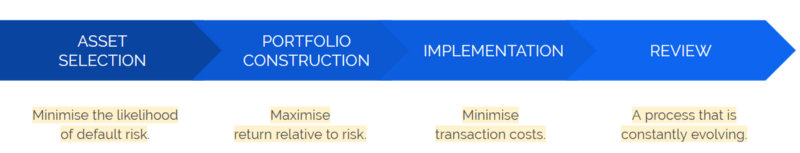

Each year we review our investment process. The review addresses any part of the process (asset selection, portfolio construction, or implementation) and aims to tweak the process with minor improvements. This year, the goal was to improve portfolio sustainability.

A Quality Franchise & ESG

ECP is committed to responsible investment and we believe that Environmental, Social and Corporate Governance (ESG) factors have a material impact on long-term investment outcomes. The consideration of ESG factors is part of our decision-making process and is fully integrated through asset selection and portfolio management procedures.

The ‘Pillars of a Quality Franchise’ is an integrated framework developed in-house to better mitigate our portfolio against ESG and sustainability risks. The initiative is a refinement of our research process which re-orientated our firm’s thinking to place greater emphasis on sustainability and stewardship.

Our proprietary framework combines six pillars and breaks down each pillar into three underlying characteristics, each part contributing to the Quality Franchise Score (QFS). Each characteristic is an assertion, or statement of truth, that we believe must be present in any company.

The framework has been designed by our investment team and is applied to all companies that we research, regardless of sector or size. Every analyst is tasked with applying this framework, with all team members required to critique and objectively evaluate the conclusions made by the authoring analyst.

The QFS is weighted toward ensuring companies achieve long-term, sustainable growth. The pillars are designed to reduce areas of uncertainty, which provides for a higher conviction that our investments will grow their economic footprint and deliver sustainable investment performance.

The pillars include Business, Industry, Competition, Sustainability, Management, and Financials. Notably, the Sustainability and Management Pillars comprise 40% of our overall QFS. The initiative deepened our research focus on ESG factors by creating a sixth pillar for Sustainability, and extended our assessment of executive leadership.

Our Sustainability Pillar encompasses three characteristics: Firstly, the business must operate in an industry with a low risk of macro-environmental factors affecting future performance. Secondly, the business has demonstrated strong ESG performance to date and holds a capacity to mitigate ESG issues. Lastly, the business has dynamic capabilities that sustainably renews its competitive advantage.

Improvements within our Management Pillar were grounded upon academically-proven elements of trustworthiness being behaviour, competency, and attitudes, and each of the assertions assesses these elements. The trustworthiness of management assists our mitigation of uncertainty by reducing the risk of managerial conduct or failure of business execution.

An Innovative Approach

Our role as a fund manager is to perform proprietary, deep research on our existing and prospective investment opportunities. As qualitative data comes in various forms — meetings, studies, videos, interviews, transcripts, desktop research etc, achieving high conviction is derived from the systematic collection and distillation of this information.

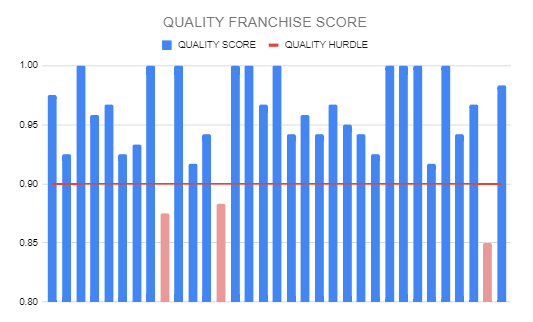

The ‘Pillars of a Quality Franchise’ framework ensures that only the companies we believe are the highest-quality, sustainable businesses are deemed investment grade (requiring QFS >90%).

Qualitative methods of research present issues of bias or indeterminate findings. Qualitative methodologies are inherently not conclusion-oriented, as it is intended to provide context around the subject. The ability to decipher the information and establish a sound conclusion leads to having higher conviction.

The framework puts the research that we do through a systematic approach which applies a system of logic and measurement. Breaking down our analysis into its components is useful in examining the information and critically analysing areas of importance, which include the long-term sustainability of investments.

Further, by separating out the identified characteristics and focusing on issues specifically (ie Sustainability), our framework provides the investment team with the opportunity to make an unbiased assessment of key business-specific issues that may impact the investment delivering per our expectations — leading us to have predictable investment outcomes.

A key principle of our framework is that each of the pillars are interdependent and interrelated. By applying this lens, we have the ability to assess how they interact with each other which provides for a better understanding of the overall quality of the business.

The Framework Applied

The updated framework provides us with a new lens which focuses greater attention on potential sustainability and ESG risks surrounding each investment. It has flagged for us areas where we need to undertake further work regarding our current portfolio, highlighting three companies that at first glance look like they would fall short of our new requirements.

Anecdotally, these investments have been under pressure over the past year as some of the identified risks played out. Whether these are one-off events, or indicative of a new regime for the companies is yet to be determined. While our investment thesis remains intact for these companies, for now, our framework has put some of these issues in focus for us, which require further research to see if the investment hypothesis remains intact.

The lessons learned from our review have been captured and implemented in our research process. Any investment deemed a Quality Franchise must pass through this strict and comprehensive framework which ensures superior sustainability and stewardship requirements.

Continual Learning

As a fundamental investor, our research process requires us to ensure that we have a systematic approach to analysing our information. We believe that the best investments are a balance of quality, growth and sustainability. However, we need a way to quantify these qualitative findings, so that we can have a measurable degree of relative conviction in our investments.

The outcome of the framework is a more pronounced focus on emerging or dormant risks that pose a threat to the predictability of earnings creation of each company. Much like our investments, our business continues to grow and learn over time — a requirement for our own sustainable performance.

The process review highlighted to us that the design of a qualitative framework can play a huge part in your ability to measure information across outcomes. While our process has not fundamentally changed, the way we’ve structured our analysis should provide us with a much clearer path to translate research into investment outcomes.

It’s important to understand both the narrative of an investment and the numbers that support it. Investing on narrative alone, ignores reality. Investing on numbers alone, ignores potential. Qualitative information helps understand and capture the narrative behind the numbers — crucial in forming a critical assessment. When a qualitative process is incorrectly implemented, none of the aforementioned lends itself to a high conviction portfolio.

ECP is a signatory to the United Nations-backed Principles for Responsible Investment (PRI) initiative. ECP is committed to responsible investment and applies the principles throughout our investment processes. The above article is an adaptation from our PRI submission.