Inflation, long-term bond yields and growth stocks are front of mind for many investors. We believe concerns of rising discount rates impacting present day valuations need to be weighed in conjunction with potential changes to business profitability. Hub24 and Netwealth are prime examples where potential profitability changes from higher inflation are likely ignored. We estimate a return of inflation could see profits 40% higher than mid-term consensus expectations.

Any keen market observer appreciates that in the short-term stocks trade as factors driven by macroeconomic variables, but as the time horizon extends, they are driven by individual business performance. For example, businesses bucketed in the technology index have seen share prices largely driven by 10-year yields in recent months, with the Australian 10-year yield up 55bps from February, the ASX 200 Tech Sector is down 20%.

This is due to the 10-year yield’s importance as a basis for the ‘risk-free rate’ in analyst valuation models globally. Growth stock valuations — software and technology in particular — often have more dependence on longer-term cash flows, increasing the sensitivity to changes in discount rates.

At ECP, to ensure we don’t overpay for high-quality, growing franchises, we are careful not to capitalise temporary market aberrations (such as artificially depressed long-term bond yields) and we skew the allocation of capital within our portfolio to our highest expected return ideas, seeking to constantly maximise the overall portfolio expected return.

That said, we believe it’s important to appreciate how changing macroeconomic environments can affect the profitability of individual businesses.

Hub24 and Netwealth

The core thesis for Hub24 and Netwealth is straightforward: clear technology leaders with 2% and 4% market shares, respectively, in the large and growing wealth platform market. Each business is increasingly taking market share, aided by a structural adviser shift to independence and general incumbent platform dissatisfaction across the industry.

With a favourable competitive structure in a large and growing market, the visibility for long-term growth is clear. However, the last two years have seen a considerable earnings headwind for Hub24 and Netwealth from falling interest rates, which we believe has now stabilised, and is set to become a future tailwind.

Yesterday’s Headwind is Tomorrow’s Tailwind

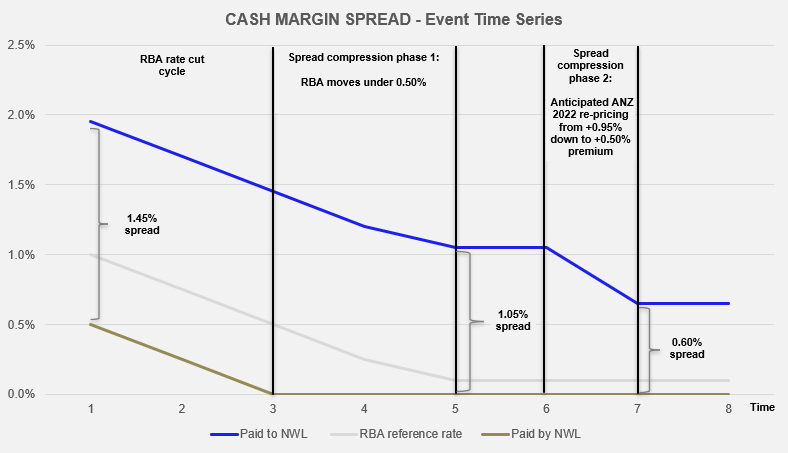

A core piece of historic profitability for Hub24 and Netwealth is the cash margin spread that the wealth platforms generate on client cash accounts. The platforms pay clients interest on uninvested cash, typically with reference to the RBA cash rate (i.e., RBA less 0.50%).

Platforms then utilise their scale, pooling tens of thousands of client accounts, and provide this cash at a wholesale rate to tier-1 banks. For example, Netwealth recently disclosed its standing contract with ANZ pays it RBA plus 0.95%.

The difference between these two rates is called the ‘cash spread’ and is retained by the platform. In Netwealth’s case, it can retain up to 1.45%. This spread is generated on uninvested cash in client accounts which have historically fluctuated between 7% and 12% of the total account value.

While historically making significant contributions to the profitability of wealth platforms, consensus expectations have been materially depressed due to the COVID crisis and RBA liquidity operations to support an economic recovery.

The first phase of cash margin spread occurred by the RBA cutting its cash rate below 0.50% in March 2020, hitting 0.10% by November. Every basis point below 0.50% ate into the spread earned by both Hub24 and Netwealth. In the Netwealth examples, the running cash spread was cut from 1.45% down to 1.05%.

In the second phase, Netwealth recently disclosed the current agreement with ANZ on its pooled cash transaction account would be terminated in 2022, likely due to ANZ seeking to renegotiate the rate lower in what is a market flush with liquidity on the back of the RBA’s quantitative easing program. Hub24’s agreement is expected to come up for renewal in late 2022.

While this event is yet to occur, it is now factored into consensus expectations, with the previous rate paid by ANZ (e.g., RBA plus 0.95%) expected to decline by up to 50bps.

In the Netwealth example, the original 1.45% spread is now forecast by consensus to be approximately 0.60% in FY23, due to indefinite low rates and excess market liquidity.

Inflation to Unlock Earnings Potential?

The RBA has undertaken its lowest target cash rate and unconventional monetary policy setting in history to accommodate Australia’s recovery from the COVID crisis. The need for this monetary policy cushion is reducing, as vaccinations roll out, confidence returns and employment levels recover.

The RBA position is not unique. Record monetary and fiscal stimulus tools are being deployed worldwide to kickstart economies, and well documented inflation concerns are beginning to arise.

With economic normalisation, extreme liquidity support and record low rates will no longer be a necessary monetary policy setting — and potentially sooner than expected.

When this period of heightened stimulus passes, we see scope for Hub24 and Netwealth cash spreads to normalise back to pre-COVID levels.

While complete spread normalisation is unlikely within the next two years, the impact would be significant when it eventually occurs. Using FY23 consensus data to demonstrate materiality, we estimate Hub24 and Netwealth would see consensus profit expectations 40% higher if historic cash spreads were present*.

Conclusion

When considering the valuation impact of rising long-term bond yields, one must consider all factors, not just the discount rate.

Hub24 and Netwealth are clear technology leaders taking share in a growing market which paves the way for continual revenue growth and operating leverage. The consensus earnings headwinds caused by excess liquidity are now behind the wealth platforms, and are set to accelerate profit growth when this economic recovery matures.

As a high conviction fund manager, ECP only invests when we have a high degree of conviction on all the long-term growth, return and risk factors in our portfolio companies. We believe it’s important to understand both the narrative of an investment and the drivers behind the numbers that support it.

* Assumes Hub24 and Netwealth uninvested client cash is 8% of custodial FUA.

The article has been prepared by ECP Asset Management Pty Ltd (ECP). ECP is a funds management firm based in Sydney, Australia. For further information, visit www.ecpam.com. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for financial advice. ECP and the analyst own shares in Hub24 Ltd, Netwealth Group Ltd. ABN 26 158 827 582, AFSL 421704, CAR 44198.