Lovisa is an attractive growth story with a global store rollout opportunity. Lovisa’s vertically integrated business model underpins their high gross margins, enabling rapid speed to market. Several firm-specific resources combine to underpin their sustainable competitive advantage, leading to superior store unit economics and an ability to replicate their stores globally. With a data-driven approach to decision-making and a continuous store network rollout opportunity based upon profitable store economics, the company is well-positioned to compound its profitability through time.

Niche Fast Fashion

Lovisa Holdings Ltd (ASX: LOV) is an ultra-niche, vertically integrated fast fashion jewellery retailer with end to end product development capabilities that delivers on-trend ranges at a low cost to the customer.

The company’s products result from taking trends straight from the latest runway shows, celebrities and social media and making them available for mass consumption as quickly as possible at affordable prices.

All the levers the company pulls, whether price, inventory management, supply and procurement, or sales and marketing, are driven to ensure the company achieves the fastest route to market at the lowest price possible.

Lovisa is aspiring to be a global fast-fashion retailer. With its international expansion well underway with ~70% of its stores operating overseas, Lovisa has a material opportunity to grow further into the US and Europe.

The company aims to replicate the success of its Australian business model and apply this to other geographies. Their corporate-owned store rollout strategy leverages their proven format while driving greater operating leverage through scale benefits.

A Resilient Business Model

Lovisa develops, designs, sources and merchandises 100% of its Lovisa branded products. This model underpins high gross margins (averaging more than 75%) and enables it to stay on-trend by being highly responsive to customer demands.

The business model uses an in-house product team, daily inventory monitoring systems, air freight transport, and scalable third-party manufacturing facilities to increase responsiveness to emerging fashion trends.

Lovisa’s product ranging and positioning in-store seeks to optimise basket size, gross margin and inventory. Further, this drives their decisions of further product development which can drive considerable same-store sales growth (SSS).

Lovisa’s stores are located in high pedestrian traffic locations within shopping malls and districts and are ~50–100 sqm. The stores are typically run by a store manager and flexible support staff, meaning they can comfortably source and manage labour.

Vertical integration provides for a cost and fashion-related competitive advantage. Product innovation (fast follower) and supply chain relationships provide efficient and speedy routes to market. The short product development cycle (8–10 weeks) drives consumed engagement while ensuring efficient cost management and scale benefits.

Product innovation and data capture enable rapid, informed feedback in their supply chain management. Effective in-store space means that only a minimum amount of warehousing space is required, and many products are shipped directly to the store.

Each week staff place stock per the planogram designed by the head office based upon the prior week’s data. The strict discipline of product placement means the company generates maximum sales from their wall space.

Additionally, a keen focus on data is central to any retailer’s success. By using data to drive a bottom-up focus on unit and store economics, the performance of each SKU is analysed in detail to maximise profit within the limited footprint.

Business Model Drives Competitive Advantage

At ECP, we assess a company’s competitive advantage through a resource-based view. Compared to a typical Porter’s Five Forces (external) view of competitiveness, we assess the (internal) resources that drive a company’s competitiveness.

The resource-based view seeks to understand why firms grow — it advances the importance of firm-specific resources that are difficult by competitors, which lead to value creation.

We have found that Quality Franchises often have multiple resources driving competitive advantages that underpin their value creation opportunity. These resources may deliver a temporary competitive advantage in isolation; however, together, they create a more sustainable advantage that’s much harder to replicate.

For Lovisa, the beauty of their business model lies in –

- Specialising in affordable jewellery (as opposed to its competitors, who mostly operate across the broader accessories and apparel) provides broader product ranges and more competitive pricing.

- Vertical integration enables on-trend product innovation, frequent inventory turnover and speed to market, allowing Lovisa to deliver competitively priced products while maintaining healthy profit margins.

- Operational scale and proven, capable leadership provides negotiating leverage with suppliers and securing preferred store locations within high-grade shopping centres and malls. Here, high traffic locations ensure higher volume per sqm.

While competitors may replicate these points alone, combining these is far more difficult. These attributes provide the operational resource that drives competitiveness, underpins store economics, and sustainable network growth.

Lovisa’s data-driven strategy ensures basket size optimisation. Lovisa uses SKU level data to feed into store layout and bundling plans to optimise profit through their planograms, with ~50% of the range altered each week — if something is working or not working in-store, Lovisa can quickly react.

Since the company develops, sources and merchandises all of its products, it can deliver an approximate 8–10 week turnaround for products to be in-store; for products demonstrating strong early sales, the company can deliver this within 4–6 weeks.

From a resource point of view, Lovisa’s business model drives its competitiveness which enables rapid network growth, underpins high gross profit margins, and strong profitability in each of the eight countries in which it operates.

Its business model is central to its competitive advantage — its organisational resource is the combination of several features that are hard to replicate and is the core driver of its ability to achieve superior rents through time.

Aligned from the Top-down

In 2021, Lovisa announced the retirement of founding CEO Shane Fallscheer. Victor Herrero was announced as the new CEO, taking the reins in December 2021.

Victor spent 13 years with the Inditex Group, one of the world’s largest fast-fashion retailers with eight store formats (including Zara, Pull & Bear and Massimo Dutti) with ~6000 stores across 80 markets.

At Inditex, Victor was Head of Asia Pacific and MD of China and led the company’s expansion through this region rolling out 800 stores across multiple countries, including China and India. Moreover, he spent four years as CEO of GUESS?, which operated ~2000 stores in 90 markets.

Victor brings a deep understanding of the global fashion industry. In his career, Victor has focused on developing and implementing market entry and expansion strategies, focusing on innovation through digital enhancement.

With Victor’s considerable experience managing a large, international store network, combined with his multi-lingual abilities (speaking five languages), and his keen ability to travel for the business, Lovisa appears well positioned with Victor at the helm.

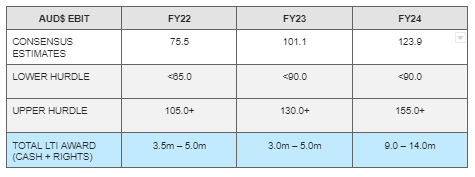

When considering the CEO’s remuneration structure, we acknowledge the (potential) substantial cost to shareholders. When assessing the breakdown of what is required to deliver the top-end of the performance criteria, most investors would appreciate the substantial shareholder value creation that will follow.

For Victor, the LTI rights are granted at no cost and the degree of vesting will depend on his performance outcomes. With a performance period of 3 years, the total LTI award value (cash plus vested performance rights) would be in the range of $15.5m — $24.0m if he were to meet current consensus estimates.

At the announcement of the LTI plan, the market expected ~700 stores by FY24. To meet the $155.0m EBIT target (the upper end of Victor’s LTI vesting targets), we estimate he would need to deliver ~1,000 stores by FY24 (using average pre-covid EBIT per store).

The recent result indicated the company may reach up to 635 stores by the end of FY22. Victor will need to increase the roll-out from 95 stores in FY22 to ~180 per annum to hit the 1000 store target. He is well incentivised to do so and benefits from returning to a post-covid operating environment.

A Fashionable Opportunity

Lovisa increases the value to consumers through on-trend products that are delivered rapidly to stores. They can deliver products from design to store within 8–10 weeks by having vertically integrated operations.

Lovisa’s highly efficient operations follow a strict store design, format, location selection, SKUs, planograms, etc. Centrally operated software provides insights into trends, inventory, and staffing, further optimising the offering and capturing created value.

Typically we are attracted to franchise store rollout opportunities, given their ability to leverage external capital to grow their economic footprint. Lovisa is appealing because their company-owned store rollout provides similar returns on equity, despite the burden of funding corporate store builds.

Part of the attractiveness of their model is that the average payback for domestic stores is ~8 months. With domestic fit-out costs in the range of $120,000 — $140,000, the short payback periods drive a substantial opportunity to drive material returns on investment.

The combination of small footprints and a homogenised layout allows Lovisa to have strict criteria when identifying and securing potential store sites, facilitating the rapid roll-out at a low cost. On average, it takes 14 days to fit out a new store.

Lovisa has refined its global store model based on what it understands to be the optimal store size, location and format. The company now operates ~70% of its stores outside of Australia, with 165 stores in Europe and 81 stores in the US.

A Vogue Approach

Lovisa is a Quality Franchise that presents a long-term opportunity for investors. The vertically integrated business model underpins high gross margins and enables rapid speed to market, while its data-driven approach provides visibility into its store network that drives its ability to exploit trends over time.

The company has successfully proven this model in Australia with a clear capability and know-how of trend-spotting, sourcing, and distributing fast-fashion jewellery. The international expansion is well underway, with most of its network operating overseas.

The strategic focus on a niche retail segment means a broader range of products and a smaller store footprint, providing rapid, profitable growth driven by a low capital expenditure corporate store roll-out strategy.

Moreover, the solid profit-generating capacity of their stores and the short payback period on store investment ensure the business has strong cash conversion, low debt, and the ability to reinvest in their store network.

Lovisa is a rare global store rollout story — a low-cost strategy, small store footprint, high gross margins and a keen focus on delivering the highest sales per sqm. The significant opportunity ahead will exploit its operational resources in driving its network expansion — this is the beauty of its business model.

The article has been prepared by ECP Asset Management Pty Ltd (ECP). ECP is a funds management firm based in Sydney, Australia. For further information, visit www.ecpam.com. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for financial advice. ECP and the analyst own shares in Lovisa Holdings Ltd. ABN 26 158 827 582, AFSL 421704, CAR 44198.