The past 20 years have been a stellar run for equities, characterised by steadily expanding production and few demand shocks, where fiscal and monetary policy enabled expansion to continue unimpeded. However, recent events have disrupted this, with the pandemic driving supply constraints, which worsened after the invasion of Ukraine, with the flow-on effect of rising interest rates creating a unique situation for policymakers to balance the trade-off of matching demand to input or inflation (but not both). For investors, the material derate of equity valuations and the expected ongoing volatility present opportunities for those focused on resilient, high-quality franchises.

The past few decades have been a golden era for most traditional assets as interest rates steadily declined and economies expanded, relishing globalisation and technological innovation. At times, this exuberance was impacted by sourcing sentiment and occasional collapses in spending, which central banks have managed through monetary policy.

This past year’s production constraints, triggered by the pandemic and accelerated by the invasion of Ukraine, have driven inflation higher worldwide. We are now living in a world that is shaped by supply, with the current inflationary environment being driven by these supply-related issues as opposed to excessive demand.

The market’s tendency to overreact to short-term events has presented investors with a unique opportunity. The best antidote to the prospect of a lower-growth, uncertain future is investments in high-quality companies that can out-grow and out-last the challenges placed before them.

The pandemic, devastating weather events, and the invasion of Ukraine are examples of macro-environmental shocks impacting companies worldwide. Portfolios that comprise resilient, sustainable investments provide a degree of comfort amidst market uncertainty and maximise the likelihood of robust returns over the long term.

Looking Back

Over the past twelve months, we have underperformed our relevant benchmark, something we have not done since 2017. While our long-term results are still excellent by any measure, this recent underperformance has prompted us to consider if we missed anything in our deliberations or if there was anything we should have done differently in our analysis.

Our investment philosophy is based on the belief that the economics of a business drives long-term investment returns, evidenced through our investment process, which delivers a portfolio of high-quality companies in the growth stage of their life cycle. Importantly, investment returns comprise two components: the dividends received and the movement in the investment portfolio’s value.

While the dividends we are likely to receive from the companies in our portfolio are relatively easy to predict and, for the most part, increase over time, the same cannot be said for the market price for the shares. Valuations are affected by investors responding to daily news feeds and commentary on local and global economic data, which have increasingly been focused on macro events.

For active investors, we must be aware of these events and understand their impact on a business’s fundamentals; however, from our experience, very little of this information is particularly useful in analysing a company’s long-term potential or operational performance.

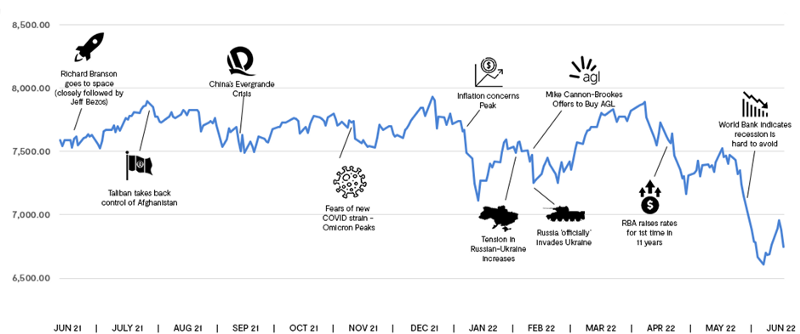

Investment returns follow earnings over the long-term; however, we can see the immediate impact of these macro events on the ASX All-Ordinaries Accumulation Index over the past twelve months in the chart below.

At the start of the financial year, the outlook was positive. Monetary policy was accommodative, corporate earnings were strong, consumer spending was buoyant, and labour markets were resilient despite numerous COVID-related restrictions.

Over time, investors contended with several events, some arriving with a degree of forewarning, while others were true, black-swan events. These included the emergence of new COVID variants and responses to contain them, a major armed conflict pushing inflation to multi-decade highs, and the resulting shift away from highly accommodative monetary policies.

In a short space of time, the view of central bankers that the uptick in inflation was “transitory” in nature and would subside in time is now “persistent”. Investor sentiment has also shifted from being optimistic to questioning whether central bankers can indeed affect a soft landing, with the outcome of this volatile period seeing a material decline in valuations.

Market cycles go through periods of excesses and corrections, and it is helpful to put this volatility into context. The ASX All Ordinaries Index, which has averaged +3.8% per annum over the past 24 years, finished down -11.1% in FY22, rebounding +6.3% in July.

Notably, any year’s annual return has never been within 10% of the average. Instead, we have five years where the losses are greater than 10% (the lowest being -26.0% in FY09), nine years where the gains are greater than 10% (the highest being +26.4% in FY21), and the remainder falling somewhere in between, but nowhere near the average.

In comparison, our All-Cap Australian equity portfolio, the ECP Growth Companies Composite, has generated annualised returns of +12.3%, with only two years of losses of more than 10% (the lowest being -24.1% in FY08) and 14 years of gains greater than 10% (the highest being +38.4% in FY21).

Through time, our portfolio performance has been driven by our ability to identify resilient, high-quality companies with sustainable business models that ensure their business economics translate to superior investment returns.

Looking Ahead

The US Federal Reserve (Fed) has indicated its plan to continue hiking interest rates, implying a rate closer to 4% in 2023. However, this delicate juggling act of taming inflation whilst not crushing demand is made even more difficult given the political backdrop.

It remains to be seen whether the Fed can orchestrate a soft-landing on what seems an increasingly narrow runway, given high inflation and slower economic growth. For investors, these dynamics drive uncertainty and volatility in equity markets, providing material opportunities for those willing to step in.

The complex systems facilitating global trade were tested by the pandemics’ rebound in global demand while being strained by the weight of the recent supply issues. For high-quality companies that have navigated these challenges while maintaining profit margins, further benefits may come.

To note, the impact of rising rates on consumer demand combined with inventory stacking this year is seeing (some) early signs of freeing production capacity. Here, the invisible hand of market forces may quell inflationary pressures for some companies in the coming year, providing further opportunity as procurement pricing and supply predictability normalises.

As Warren Buffett commented in his Letter to Shareholders (1989), “time is the friend of the wonderful business, the enemy of the mediocre”. For investors, identifying quality companies is the true secret to success in growing one’s long-term wealth.

While market uncertainty continues, it is challenging for investors to recognise the potential in companies, particularly those that are in the growth stage of their life cycle. It can be difficult to separate the narratives from the numbers and, in doing so, isolate the truly exceptional companies from the rest.

The investments with a Sustainable Competitive Advantage (SCA) will be well-placed to withstand short-term headwinds and use this as an opportunity to maintain or take market share and ultimately find new ways to grow.

Companies such as Rio Tinto Limited (ASX: RIO), whose share price is affected by extreme short-term volatility in the commodity markets and which is not a glamour growth stock in the mould of most tech stocks, have nearly doubled their turnover over the past five years and increased its dividend six-fold.

CSL Limited (ASX: CSL) has continued to invest in plasma capacity despite being impacted by pandemic-related supply reductions. Through time, the company has demonstrated a powerful ability to identify new growth opportunities, investing in the Chronic Kidney Disease franchise Vifor Pharma.

While PWR Holdings Ltd (ASX: PWH) continues to double down on its bespoke thermal cooling solutions seeing revenues double over the past five years. Through continued investment in technology and capabilities, the company has expanded market applications in their Emerging Technologies division which is expected to grow five-fold over the next few years.

Invest in Resilient Investments

Market uncertainty continues to reign supreme. The sectoral reallocation over the past few years is still normalising, the transition to net zero carbon emissions is now accelerating, and unprecedented leverage globally are some macro-environmental factors continuing to play decisive roles in business outlooks, with related risk premiums rising.

Throughout reporting season we drilled down into company financials and growth plans in a careful, considered and committed way. This process ensures we identify the quality stocks that are resilient through these challenges and will prosper over the long term.

Recently, our portfolio’s improved company P/E ratings (from recent lows) and has shown continued strength in short-term financial metrics (i.e. sales growth, earnings and dividend growth). These indicators give us confidence in the outlook and provide the impetus for handsome improvement in valuations — equating to a current estimate of the expected IRR for the portfolio to be ~14%.

In a connected world, events that occur on one side of the world ripple through to the other. Investing in these times requires a holistic approach that considers these external events, understands business sustainability, and recognises dynamic capabilities that empower them to survive and thrive from black swan events.

For investors, taking advantage of the current market uncertainty is not for the faint-hearted. However, the material derates of equity valuations and the expected ongoing volatility present a material opportunity for those focused on these resilient, high-quality franchises.

The article has been prepared by ECP Asset Management Pty Ltd (ECP). ECP is a funds management firm based in Sydney, Australia. For further information, visit www.ecpam.com This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for financial advice. ECP and the Chairman own shares in Rio Tinto Limited, CSL Limited, and PWR Holdings Ltd. ABN 26 158 827 582, AFSL 421704, CAR 44198.