Before we go into Christmas, I wanted to put pen to paper, and reflect back on the year that was. 2018 marked some key milestones for ECP Asset Management (ECP). The most important of which, was the firm delivering its maiden set of five year returns in August.

At the core of our values here at ECP Asset Management (ECP) is the belief that the underlying economics of a business drives its long-term returns. We believe that companies who are growing their economic footprint (profitably) are generally better investment opportunities than those that aren’t. We would rather invest in a smaller number of companies which we understand well, than a large number of companies where we have cursory understanding. Finally, as a custodian of other people’s money, we owe it to those who’ve invested alongside us, to allocate their capital to opportunities that we believe in, because we’ve done the work.

When we founded the business, we carefully articulated our brand promise and created the necessary performance measures needed to track that promise to customers. There were three in total: first, we will never speculate to generate returns. Secondly, we buy high-quality franchises for the long-term and do not trade them; and, finally, we do not diversify to cover up for poor due diligence. I’m happy to say that we’ve delivered on these promises to our investors by investing in only a handful of companies each year, but reviewing hundreds and researching a fraction of those in depth.

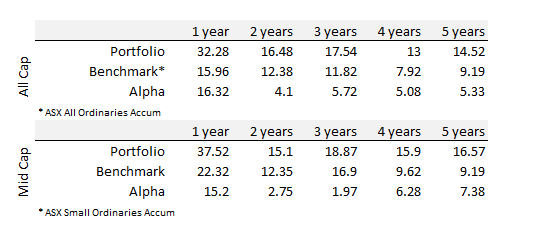

I am very proud of our team for the hard work they have put in to delivering an enviable set of returns; placing us in the top of the top quartile of managers in Australia based on the Morningstar Survey.

Redefining Active Investing

All of our readers would note, that this year, we went through a brand refresh. The point of this refresh was to ensure that we were able to articulate more clearly what we have been doing for a long time. Many hours of work by our creative team went into distilling what we do into its essence. The result of which was to set ourselves the task — to Redefine Active Investing.

We believe the only way to grow sustainable wealth that is resilient through time is to invest money in a careful, considered and committed way. We contend that this is ‘active’ investing.

We believe Active Investing requires:

1. Forensic Research

Considerable factors need to line up before we invest in a business. For example, a sound business strategy that is contextually relevant to the markets they operate. A durable business model with a Sustainable Competitive Advantage (SCA) that management have previously demonstrated a strong competency of execution.

2. Understanding Potential, not just Performance

We believe it’s important to understand both the narrative of an investment and the numbers that support it. Investing on the narrative alone, ignores reality; and investing on numbers alone, ignores potential. We marry the two together so that we can best capture the long-term potential while ensuring that we pay a fair price.

3. Being Highly Engaged with Portfolio Companies

To make high conviction investment decisions and to maintain these over the long-term requires deep understanding and a lot of time and attention. It means we need to think about investing as an owner, and not a share trader. As a result, we only have time for our best ideas and we continue to monitor and assess these through collaborative and discursive practices.

Over the past twelve months we have several new companies to the portfolio. Of these new names, I would like to briefly comment on a couple of investments given the some of the work we did, received a lot of attention.

Corporate Travel Management (CTD)

CTD is a corporate travel provider to the SME market, both domestically and abroad. It is focused on providing high-quality customer service to its corporate customers to ensure a superior customer experience. CTD uses its own proprietary technology and tools to facilitate this service and this has enabled them to leverage existing staff and offerings to grow earnings margins. The unique focus on ROI outcomes for the customer has been a key driver of their success. We believe they can continue to use this model as they expand into new markets via sensible acquisitions.

CTD suffered from a short report alleging poor managerial decisions, aggressive accounting and poor disclosure practices. For us, our research gave us comfort around the claims in the report and allowed us to maintained high conviction in the management team and the business model despite the negative market commentary. Continually adding incremental information to our knowledge base, we have explored areas of the business that most market participants have not been aware of and on the back of any knee-jerk market reactions, we act with a flight to quality.

We expect the historical growth profile of the business to continue through our investment horizon. The growth runway is large, particularly in Europe and the USA, where they have low market share and have not yet hit critical mass. Their success is enabled by a unique organisational competitive advantage that is complimented by their strong culture — a critical element to a service-orientated business. CTD have a top-down focus on customer service and their technology stack enables them to facilitate the focus on returns to the end customer. CTD is a quality franchise and their performance to date is a great indicator of their potential into the future.

The article we published on what we believed the key issues with CTD were, can be found here.

Afterpay Touch (APT)

APT is an incredibly exciting prospect over the long-term. APT is disrupting the consumer credit industry with a reverse layby product that is in the process of rapid consumer and merchant adoption. The success of attracting over two million customers to-date is driven by the product success factors which we define as (1) simplicity; and (2) interest and fee free. We see significant headway to grow the Australian customer base and increase “share of wallet” which translates to material profit growth above consensus. The opportunity for continued penetration in Australia forms the basis of our investment case.

APT’s successful execution in Australia has provided it with the first mover advantage and has established a strong brand and an encompassing network effect between consumers and merchants. This underpins their SCA which we believe is under-appreciated by the market and this is deepening as the network continues to grow. For us, the high engagement with the company, proprietary research through interviews, surveys, and other techniques, we believe our forensic research has provided us with a unique (owners) perspective. We believe we understand the potential of APT, not just its recent performance, and the narrative will continue to translate into meaningful performance over time.

Furthermore, the recent move into the US creates considerable upside to our investment thesis and is a market opportunity 10–20x Australia. We believe the same product success factors will apply and we have high conviction in the management team to execute their strategy successfully. APT’s SCA in Australia is multi-pronged: Its network effect; first mover advantage; and its reputation in a market which has seen the brand become a verb. A simple example is Google — “Just google it!”.

One of the core issues surrounding APT has been the regulation overhang. We published our thoughts on the likely regulation path in Australia here. In the article we spoke to how we thought the regulatory risks were overblown.

We’d rather Sleep Well than Eat Well

Investment management is more than merely generating alpha in excess of a benchmark. While that is a core part of our mandate, there are other very important qualitative issues that are central to what we do. For example, we recognise that capital allocation is a vehicle through which to drive change. We have the opportunity to demand specific standards of corporate governance, decide whether specific social and ethical issues are acceptable and, if they are not, we vote with our feet.

For us, the integrity and credibility of any management team is a founding principle to our investment process. We need to trust that management have the best interests for all stakeholders and we have faith that they will make sound strategic decisions and have strong experience and capabilities in their chosen field. As custodians of our clients’ capital, we have an obligation to ensure that we are doing whatever we can to preserve capital and grow it over time. We allocate capital to investments which are sustainable in the long-term, and finding trustworthy, values-based management that align with our core values and beliefs that will ensure above-average economic portfolio returns.

Thank you all for your support over the year and we hope that you, your families and friends have a fantastic festive season, and we look forward to returning to the markets again in 2019.

All the best,

Manny